Best Ways to Negotiate with Creditors

Understanding Your Strengths

Your negotiating power isn't solely determined by your job title or position at the table. What truly matters is the unique value you bring - whether that's specialized knowledge, industry connections, or problem-solving abilities. Taking inventory of these assets gives you concrete leverage points to reference during discussions. When you clearly articulate how your contributions benefit the other party, you shift from simply asking to demonstrating mutual value.

Beyond obvious qualifications, consider less tangible strengths like your ability to read people or your reputation for fair dealing. These soft skills often prove just as valuable as technical expertise when building productive negotiation relationships.

Assessing Your Alternatives

Smart negotiators always have a Plan B. This isn't about being distrustful - it's practical preparation. Knowing your walk-away options prevents desperation from clouding your judgment when talks get tough. Research shows negotiators with strong alternatives consistently achieve better outcomes.

Your alternatives might include other vendors, different solutions, or even postponing the decision. The key is documenting these options beforehand so you can reference them objectively during tense moments rather than making emotional decisions.

Evaluating the Other Party's Needs and Motivation

Great negotiators listen more than they talk. By asking thoughtful questions about the other side's constraints and objectives, you often uncover hidden flexibility points. Their stated position usually represents their ideal outcome, but their underlying interests reveal where they might compromise.

Pay attention to what they emphasize repeatedly - these are likely their true priorities. Similarly, notice what they avoid discussing, as these may be sensitive areas where creative solutions could break deadlocks.

Recognizing External Factors

Market conditions create invisible leverage in every negotiation. An economic downturn might make price more sensitive, while industry disruptions could increase demand for innovative solutions. Savvy negotiators monitor these macroeconomic signals to time their discussions strategically.

Regulatory changes often create unexpected negotiation opportunities too. New compliance requirements might make your specialized knowledge suddenly more valuable, allowing you to renegotiate existing agreements.

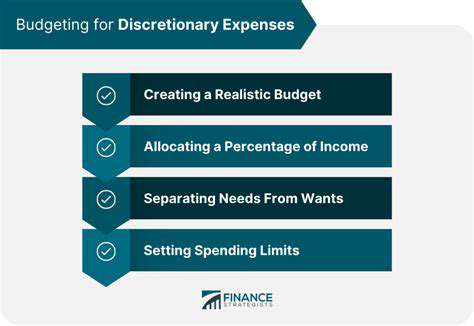

Analyzing the Importance of the Issue

Not all negotiation points carry equal weight. Distinguishing between must-haves and nice-to-haves prevents wasted effort on minor issues. This prioritization helps you trade concessions strategically rather than getting bogged down on every detail.

Consider creating a simple scoring system for your priorities before negotiations begin. This quantitative approach helps maintain objectivity when emotions run high during discussions.

Leveraging Your Resources and Expertise

Specialized knowledge becomes negotiating power when presented effectively. Rather than simply listing credentials, demonstrate how your unique capabilities solve the other party's specific challenges. Case studies and testimonials often speak louder than assertions.

If you lack certain resources, consider strategic partnerships that fill those gaps. Presenting a complete solution package increases your value proposition beyond what you could offer alone.

Crafting a Compelling Negotiation Strategy: Presenting a Strong Case

Understanding Your Needs and Goals

Effective negotiation preparation begins with ruthless prioritization. Distinguish between your ideal outcome, acceptable compromises, and absolute deal-breakers. This clarity prevents you from conceding important points simply to reach agreement.

Document your rationale for each position. When you can explain why terms matter (beyond we want it), you're more persuasive and better equipped to counter objections.

Analyzing the Other Party's Position

Map their likely priorities using available information - annual reports, industry trends, even job postings can reveal pain points. Anticipating their arguments lets you prepare rebuttals that address their concerns while advancing your position.

Consider their organizational constraints too. Budget cycles, approval processes, and internal politics often influence their flexibility more than they'll admit.

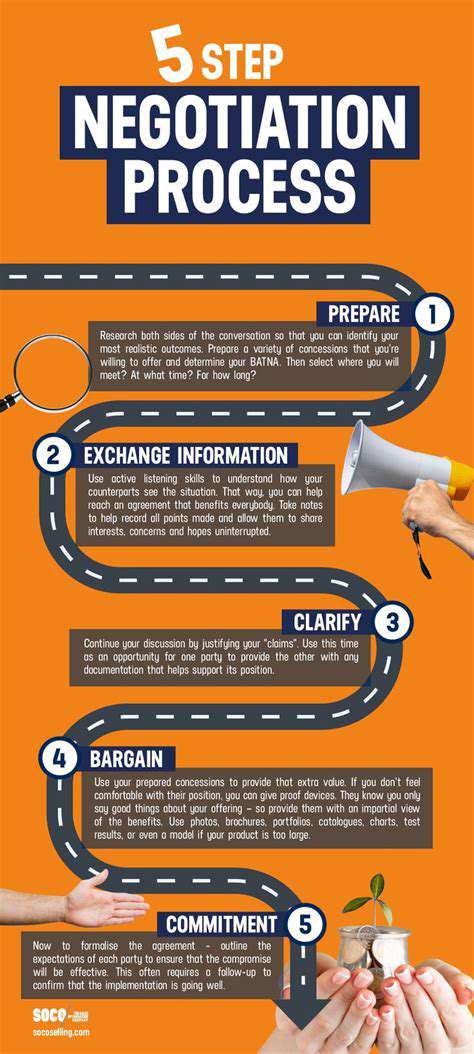

Developing a Negotiation Strategy

Structure your approach like a chess game - plan multiple moves ahead. Determine your opening position, expected counteroffers, and concession strategy. The most effective negotiators know exactly which concessions to trade and when to hold firm.

Build in checkpoints to reassess if talks stall. Sometimes taking breaks to consult colleagues or gather additional information creates new momentum.

Effective Communication Techniques

Replace adversarial language with collaborative framing. Instead of your demand is unreasonable, try help me understand how that supports our shared goals. This subtle shift maintains tension on issues while preserving relationship quality.

Use silence strategically. Pausing after statements or offers often prompts the other party to reveal more than they intended.

Building Rapport and Trust

Find genuine common ground early - shared professional challenges, mutual contacts, or even non-business interests. People concede more readily to those they like and respect.

Small gestures matter. Accommodating scheduling requests or providing helpful information builds goodwill that pays dividends during tough discussions.

Handling Difficult Situations

When talks stall, reframe rather than resist. What if we approached this differently... introduces new options without confrontation. The word yet is powerful - We haven't found common ground yet implies solvability.

If tensions rise, suggest tabling contentious issues to address easier ones first. Success with small agreements creates momentum for tougher topics.

Closing the Deal and Following Up

Summarize agreements in writing immediately after meetings, even if just in email. This prevents later disputes over what we agreed.

Post-negotiation, deliver exactly what you promised when you promised it. Nothing builds trust for future negotiations like flawless execution.

Communicating Effectively with Creditors: Building Strong Relationships

Effective Communication Strategies

Creditor relationships thrive on transparency and reliability. Proactive communication about challenges builds more goodwill than excuses after deadlines are missed. Regular updates - even when there's no change - demonstrate professionalism.

Tailor your communication style to each creditor. Some prefer detailed written explanations while others value concise bullet points. Mirroring their preferred approach increases receptivity.

Understanding Different Communication Styles

Financial professionals often use precise language - mirror this in your communications. Avoid vague promises like soon in favor of specific dates, even if conservative. Creditors respect borrowers who under-promise and over-deliver.

Recognize that collection agents have different incentives than relationship managers. Adjust your approach accordingly while maintaining consistent facts.

Active Listening and Feedback Mechanisms

When creditors raise concerns, paraphrase their points to confirm understanding. What I hear you saying is... demonstrates engagement and surfaces any miscommunications early.

Ask clarifying questions about their processes. Understanding their approval workflows helps you time requests strategically.

Nonverbal Communication Cues

In face-to-face meetings, maintain appropriate eye contact and avoid defensive postures. Your physical demeanor often communicates confidence (or lack thereof) more than words.

Even in written communication, formatting matters. Well-structured emails with clear headings project competence better than dense paragraphs.

Overcoming Communication Barriers

When discussing financial difficulties, separate facts from emotions. Present clear documentation rather than emotional appeals. Creditors respond better to data-driven proposals than hardship stories.

If language barriers exist, consider using visual aids like charts or graphs to supplement verbal explanations.

Air leak detection requires systematic investigation rather than guesswork. Begin with the most common culprits - windows and doors - using the dollar bill test (if a closed bill pulls out easily, you have gaps). Professional energy audits often identify less obvious leaks that DIY methods miss.

Maintaining a Positive Credit History: Long-Term Implications

Understanding Credit Scores and Their Importance

Think of your credit score as a financial GPA that follows you for decades. Landlords, insurers, and even employers now consider it when making decisions. A single 30-day late payment can linger on your report for seven years, while positive habits compound over time.

The scoring models weigh recent behavior more heavily. This means you can improve mediocre scores faster than many realize through consistent good habits.

Strategies for Building and Maintaining a Positive Credit History

Automate minimum payments as a safety net, but aim to pay balances fully. Carrying small balances doesn't help your score despite common myths.

If rebuilding credit, consider becoming an authorized user on a family member's longstanding account. Their positive history can boost your profile when used responsibly.

Avoiding Credit Mistakes That Damage Your Score

Closing old accounts shortens your credit history length - one of the scoring factors. Instead of closing unused cards, make small recurring charges (like streaming services) and auto-pay them.

Credit inquiries fall into two categories - rate shopping for loans within a 45-day window counts as one inquiry, while multiple card applications do cumulative damage.

The Long-Term Benefits of a Strong Credit History

Exceptional credit opens doors beyond borrowing - it can mean lower insurance premiums, waived utility deposits, and better rental options. Over a lifetime, the compound savings often exceed six figures.

Perhaps most valuable is the reduced stress that comes with financial flexibility. When emergencies arise, good credit provides options rather than desperation.

Read more about Best Ways to Negotiate with Creditors

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt