Guide to Investing in Gold vs Silver

Why Gold Remains a Popular Investment

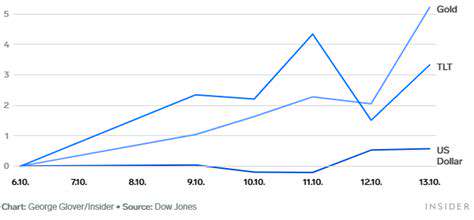

Gold's legacy as a store of wealth spans millennia, maintaining its appeal among both individual and institutional investors. The metal's finite supply and historical stability attract attention during financial uncertainty. This enduring preference stems from gold's demonstrated capacity to preserve value across generations, offering protection against economic instability. Historical data reveals gold's exceptional ability to maintain purchasing power despite market turbulence. Such resilience positions it as an attractive option for conservative, long-term investment strategies.

Gold's Role as a Hedge Against Inflation

Gold's effectiveness as an inflation buffer represents one of its most compelling investment arguments. When currency values diminish due to price increases, gold typically retains its real worth. This phenomenon occurs because gold supply grows slowly, unlike fiat currencies that central banks can expand rapidly. This fundamental difference makes gold particularly valuable in economies experiencing monetary devaluation.

The established relationship between gold valuation and inflationary periods informs many investment decisions. Including gold in asset holdings can help offset the erosive effects of rising prices on investment portfolios.

Diversification Benefits of Gold in a Portfolio

Strategic gold allocation can substantially improve portfolio stability during market contractions. Gold frequently moves inversely to conventional assets like equities and fixed-income securities. When stock values decline, gold prices often appreciate, creating a balancing effect. This countercyclical behavior helps reduce overall portfolio volatility during economic downturns. A thoughtfully constructed investment mix incorporating gold typically demonstrates greater equilibrium and reduced risk exposure.

The Importance of Physical Gold Holdings

While various financial instruments provide gold exposure, physical possession offers distinct advantages. Tangible gold provides direct asset ownership, eliminating counterparty risk associated with paper instruments. The psychological comfort of physical possession appeals to many conservative investors, reinforcing gold's reputation as a reliable store of value.

Understanding the Risks and Considerations

Despite its advantages, gold investment carries specific challenges requiring careful evaluation. Price volatility can affect short-term returns, necessitating appropriate time horizons. Physical gold ownership introduces considerations regarding secure storage and insurance requirements. Successful gold investment demands thorough understanding of market dynamics and personal financial objectives. Professional financial guidance can prove invaluable when incorporating gold into investment strategies.

Silver: A Multifaceted Metal with Diverse Applications

Silver's Industrial Applications

Silver's unparalleled electrical performance and reflective qualities make it essential for modern technology. Advanced electronics rely on silver for efficient current transmission with minimal energy loss. The metal's corrosion resistance further enhances its suitability for demanding industrial environments requiring long-term reliability.

Silver's natural antimicrobial characteristics benefit numerous products promoting hygiene and safety. Medical devices, food preservation systems, and water treatment technologies all utilize silver's consistent germicidal properties, demonstrating its versatility beyond purely industrial uses.

Silver's Role in Photography and Art

Traditional photography depended heavily on silver's light-sensitive properties, creating the foundation for image capture. Although digital technology has reduced this application, silver's artistic legacy continues to inspire creative professionals. The metal's workability and luminous quality maintain its status as a preferred medium for sculptors and jewelry designers seeking to create enduring artworks.

Silver's Investment Potential

As a precious metal, silver's market value responds to complex supply-demand dynamics. Investors must consider multiple factors including industrial consumption patterns and macroeconomic conditions when evaluating silver's investment merits. While offering growth potential, silver markets require careful analysis to navigate their inherent volatility successfully.

Silver's Coinage and Collectible Value

Silver's monetary use dates to ancient civilizations, reflecting its enduring value recognition. Modern collectors prize historical silver coins and bars for their numismatic significance, with rare specimens commanding substantial premiums. This dual role as both monetary instrument and collectible enhances silver's appeal to diverse investor profiles.

Silver's Jewelry and Decorative Applications

Silver's radiant appearance and workability make it a perennial favorite for decorative arts. Jewelry designers value its ability to transform into intricate patterns, while its relative affordability compared to gold expands its consumer appeal. The metal's cultural significance across civilizations reinforces its status as both artistic medium and valuable commodity.

Selecting an appropriately sized campsite significantly impacts outdoor enjoyment. Evaluate your group size and equipment requirements carefully. Solo adventurers might manage with compact sites, while larger groups need expanded space for comfort. Proper space assessment prevents congestion and enhances everyone's nature experience. Consider functional requirements like tent placement, cooking areas, and storage space when evaluating potential sites.

Read more about Guide to Investing in Gold vs Silver

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![Best Budgeting Apps for 2025 [Top Picks]](/static/images/30/2025-05/AdvancedBudgetingAppswithInvestmentTools.jpg)

![How to Cut Unnecessary Expenses [Actionable Steps]](/static/images/30/2025-05/NegotiatingBillsandUtilizingDiscounts.jpg)

![Best Investment Strategies for High Inflation Environments [2025]](/static/images/30/2025-05/BeyondtheBasics3AExploringAlternativeInvestments.jpg)