Guide to Retirement Planning for Business Owners

Maximizing Retirement Savings and Investments

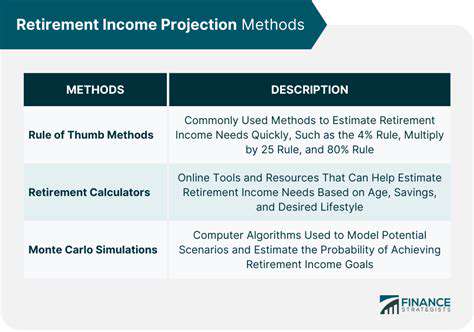

Understanding Your Retirement Needs

Planning for retirement goes beyond simply stashing away money—it requires a thoughtful examination of your future lifestyle and anticipated expenses. The foundation of any solid retirement plan begins with an honest assessment of your projected financial requirements. Take time to analyze your current living costs, potential medical expenses, dream vacations, and other financial commitments you expect during retirement. Precise estimates are vital to crafting a savings approach that matches your long-term aspirations.

Don't overlook factors like inflation, which can quietly diminish your savings' buying power over decades. Equally important is establishing your retirement timeline, as this will directly influence the investment methods you choose to grow your nest egg.

Diversifying Your Investment Portfolio

Diversification stands as the bedrock of prudent investing, particularly when building retirement wealth. By allocating your funds across different asset categories—stocks, bonds, real estate, and possibly alternative investments—you create a buffer against market volatility. This strategy prevents your entire portfolio from being vulnerable to the ups and downs of any single investment.

A properly diversified portfolio acts as a shock absorber during economic downturns, offering more consistent returns over extended periods. Remember, the objective isn't to eliminate risk entirely, but to control it wisely to safeguard your retirement funds.

The Power of Early Savings

Starting your retirement savings journey early unlocks the remarkable potential of compound growth. Even modest, regular contributions made over several decades can blossom into significant sums thanks to compounding. This principle proves especially crucial for those who begin saving later in their careers or with limited initial resources.

Establish practical savings targets and maintain disciplined saving habits. Beginning early gives your money more time to work for you, potentially leading to a more secure and enjoyable retirement.

Tax-Advantaged Retirement Accounts

Leveraging retirement accounts with tax benefits—like 401(k)s, traditional IRAs, and Roth IRAs—can dramatically enhance your savings growth. These specialized accounts provide either immediate tax deductions or tax-free earnings, both of which can meaningfully increase your total retirement funds.

Each account type comes with specific regulations and advantages. Carefully evaluate your personal financial picture and tax situation to identify which options best support your retirement objectives.

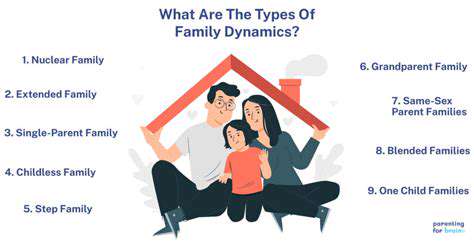

Retirement Planning Strategies for Different Life Stages

Effective retirement planning adapts as you progress through life. Early-career professionals might prioritize maxing out retirement contributions while establishing emergency funds. Those in mid-career often focus on accelerating savings and refining long-term investment approaches.

For individuals nearing retirement, the emphasis typically shifts to adjusting investment mixes, reducing risk exposure, and guaranteeing adequate income streams for their golden years. A customized plan that reflects your unique circumstances remains essential for successful retirement preparation.

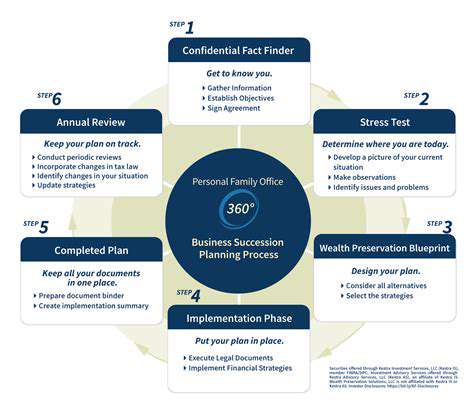

The Importance of Professional Advice

Consulting with an experienced financial advisor can prove invaluable when navigating retirement planning complexities. These professionals offer tailored recommendations based on your specific financial position, comfort with risk, and retirement vision.

They can assist in developing a holistic financial blueprint that addresses savings optimization, investment diversification, and estate planning—all customized to your individual requirements. Never underestimate the value of expert guidance when making critical decisions about your financial future.

Read more about Guide to Retirement Planning for Business Owners

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![Best Investing Books for Absolute Beginners [2025]](/static/images/30/2025-05/PracticalApplication3ABuildingYourInvestmentPlan.jpg)

![Best Investment Strategies for High Inflation Environments [2025]](/static/images/30/2025-05/BeyondtheBasics3AExploringAlternativeInvestments.jpg)