Best Strategies for Funding Healthcare in Retirement

Understanding Medicare Coverage

Medicare is a federal health insurance program in the United States, designed to provide health coverage for people aged 65 and older, as well as certain younger people with disabilities. Understanding the different parts of Medicare, including Part A, Part B, Part C (Medicare Advantage), and Part D (prescription drug coverage), is crucial for maximizing benefits. Knowing what each part covers and the associated costs is essential to avoid surprises and ensure you are getting the most out of your coverage.

Choosing the Right Medicare Plan

There are many different Medicare plans available, and the best one for you will depend on your individual needs and circumstances. Factors such as your health status, location, and budget should all play a role in your decision. Comparing plans and their coverage options is a critical step in finding the most beneficial plan for your specific needs. Consider factors such as out-of-pocket costs, covered services, and provider networks.

Navigating Medicare Enrollment Periods

Understanding the annual Medicare enrollment periods, known as Open Enrollment, is essential to avoid penalties and ensure you have continuous coverage. These periods offer opportunities to switch plans or enroll for the first time, allowing you to tailor your coverage to your evolving needs. Failing to enroll during these periods can lead to higher premiums and limitations on coverage in the future.

Utilizing Medicare Resources

Medicare offers various resources to help beneficiaries understand their coverage and navigate the program. These resources range from online tools and guides to local assistance programs. Taking advantage of these resources can significantly enhance your understanding of Medicare and its intricacies, empowering you to make informed decisions. Utilize these tools to discover relevant information and support.

Exploring Medicare Advantage Plans

Medicare Advantage plans, or Part C, offer an alternative way to receive your Medicare benefits. These plans often include additional benefits beyond what's covered in original Medicare, such as vision, dental, and hearing coverage. These plans may offer more comprehensive coverage than traditional Medicare, but it's vital to carefully analyze the specific benefits and cost-sharing amounts. Evaluate the coverage and cost-sharing structures to ensure they align with your financial and health requirements.

Managing Medicare Costs

Managing Medicare costs is crucial for maintaining financial stability. There are various strategies to help control expenses, such as understanding cost-sharing, exploring financial assistance programs, and making informed choices about your coverage options. Understanding the various cost-sharing components and exploring financial assistance programs is a vital step in controlling your Medicare costs. Be proactive in managing your out-of-pocket expenses.

Seeking Professional Guidance

Don't hesitate to seek guidance from qualified professionals, such as insurance agents or counselors specializing in Medicare plans. These professionals can provide personalized advice and support in understanding your coverage options and maximizing your benefits. Consulting with a qualified professional can provide personalized guidance and insights, ensuring your Medicare plan aligns with your unique needs. This can help you navigate the complexities of Medicare and make informed decisions.

Leveraging Retirement Savings for Healthcare Expenses

Maximizing Your Retirement Savings

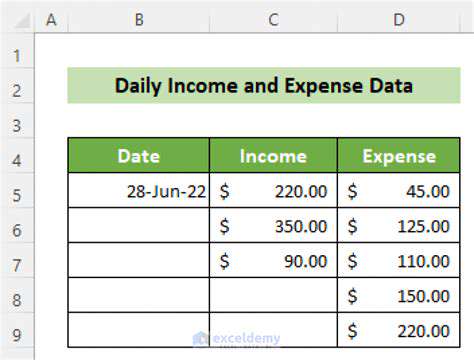

Retirement planning is a crucial aspect of financial well-being, and effectively leveraging your retirement savings is essential for a comfortable and secure future. Understanding how to maximize your contributions and manage your investments is key to achieving your retirement goals. This involves careful consideration of your income, expenses, and desired lifestyle in retirement. A well-structured savings plan, coupled with smart investment strategies, can significantly impact your financial security in your later years.

There are various strategies to optimize your savings, including tax-advantaged accounts like 401(k)s and IRAs. Understanding the nuances of these accounts and how they interact with your overall financial picture is critical to making informed decisions. Choosing the right investment options and maintaining a diversified portfolio can help you mitigate risk and maximize returns. Consistent contributions, even small ones, over time can significantly impact your long-term savings growth.

Strategies for Growth and Preservation

Beyond simply saving, strategic growth and preservation of your retirement funds are crucial for long-term financial security. This involves a thoughtful approach to investment choices, considering risk tolerance and potential returns. Diversification across different asset classes, such as stocks, bonds, and real estate, can help balance risk and potentially enhance returns.

Regularly reviewing and adjusting your investment portfolio is vital. Market conditions and personal circumstances can change, requiring adjustments to your strategy. Seeking professional financial advice can provide valuable insights and guidance in navigating these complexities. Understanding market trends and economic conditions can also help in making informed decisions about your investments.

Careful consideration of fees and expenses associated with investment products is also essential. Comparing various investment options and understanding the associated costs can help you make the most efficient choices. Choosing investments that align with your long-term goals and risk tolerance can contribute to more successful retirement planning.

Tax Implications and Financial Planning

Tax implications play a significant role in retirement savings strategies. Understanding how different investment choices and account types affect your tax liability is crucial for optimizing your savings. Taking advantage of tax-advantaged retirement accounts like 401(k)s and IRAs can potentially reduce your current tax burden and maximize your savings.

Developing a comprehensive financial plan that integrates your retirement savings with other financial goals is important. This includes considering factors like healthcare costs, potential estate planning needs, and other expenses in retirement. A financial advisor can help you create a personalized plan that aligns with your individual circumstances and objectives. Carefully considering potential tax implications and adjusting your strategy accordingly can save you a considerable amount in the long run.

Long-Term Care Insurance: A Proactive Approach to Future Needs

Understanding Your Future Needs

Long-term care insurance isn't just about planning for a specific illness or injury; it's about proactively addressing the potential for future needs that could impact your independence and financial security. Consider the diverse range of potential care scenarios, from assisted living to skilled nursing facilities, and how these scenarios might impact your lifestyle and finances over the long term. Evaluating your current health, lifestyle, and family history can provide valuable insights into potential future care requirements.

Assessing your current resources and projected income is also crucial. Will your savings and retirement funds be sufficient to cover potential care costs? Understanding your financial situation in the context of future care needs is essential for making informed decisions about insurance coverage.

The Importance of Early Planning

Proactive planning for long-term care needs is significantly more effective when initiated early in life. Waiting until a crisis arises can often lead to higher premiums and potentially limited coverage options. This early planning allows you to carefully consider different policy types, features, and benefits, ensuring you choose a plan that best suits your individual circumstances and financial goals.

Taking charge of your future well-being through early planning demonstrates a commitment to long-term financial security. It's about ensuring you're prepared for potential challenges and maintaining a high quality of life, even as your needs evolve.

Comparing Different Policy Types

Long-term care insurance policies vary significantly in terms of coverage amounts, benefit periods, and specific services covered. Understanding the differences between traditional policies, hybrid policies, and other specialized options is critical to selecting the right fit for your circumstances. Compare the features and benefits offered by various providers to ensure you're making an informed decision.

Researching different policy types, including those with inflation protection or riders, helps you assess their suitability. Explore the specific terms and conditions related to daily living assistance and the level of care anticipated in your particular situation.

Assessing Coverage Options

Evaluating the various coverage options available is a vital step in the planning process. Factors to consider include the duration of care covered, the daily or monthly benefit amounts, and any limitations or exclusions. Carefully review the policy's specific definitions of qualifying events and how they might impact your coverage.

Evaluating Premiums and Costs

Premiums for long-term care insurance can vary greatly based on factors such as age, health, and the specific coverage desired. Researching different insurance providers and comparing their pricing structures is crucial. Understanding the potential long-term costs associated with the insurance policy, including premiums and out-of-pocket expenses, is essential for budgeting purposes.

Consider the long-term financial implications of the premiums and associated costs. Compare various policy options and assess the potential return on investment in terms of peace of mind and protection against future care expenses.

Seeking Professional Advice

Consulting with a qualified financial advisor or insurance professional is highly recommended. They can provide personalized guidance based on your specific needs and circumstances. Experts can help you navigate the complexities of long-term care insurance and make informed decisions that align with your financial goals.

Leveraging the expertise of a professional advisor can provide clarity and save you time and effort in exploring the various options. They can help you understand the nuances of insurance policies and ensure you choose a plan that provides the best possible coverage and value.

Read more about Best Strategies for Funding Healthcare in Retirement

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![How to Build an Emergency Fund [Step by Step]](/static/images/30/2025-04/Step53AReplenishYourEmergencyFundWhenNecessary.jpg)

![Best Travel Insurance Policies [2025 Review]](/static/images/30/2025-05/CrucialConsiderations3ATripTypeandDestinationImpact.jpg)