How to Budget for Home Renovations

Understanding Your Needs

Before jumping into home improvements, pause to evaluate what you truly need. Are you renovating to boost resale value or simply to enhance your living space? This fundamental question shapes your entire project's scope and budget. Whether it's a kitchen facelift, bathroom upgrade, or full-room transformation, careful planning now prevents expensive regrets later. Your vision must align with both your dreams and your bank account.

Pinpoint exact pain points in your current space. That awkward kitchen layout that wastes steps? The bathroom with insufficient storage? Clear problem identification leads to smarter solutions and avoids wasteful spending. Effective renovations balance beauty with practicality - they should make daily life easier, not just prettier.

Gathering Accurate Estimates

Online calculators provide ballpark figures at best. For true accuracy, collect multiple professional bids. Seasoned contractors spot issues you might miss and can detail material costs, labor hours, and potential surprises. Insist on itemized proposals showing exact work scopes, material specifications, and line-item pricing. This transparency prevents sticker shock later.

When comparing quotes, specify your quality expectations upfront. Will you splurge on marble countertops or opt for durable quartz? Discuss material alternatives and their cost implications thoroughly before signing contracts. Never hesitate to ask contractors to explain anything unclear in their proposals.

Material Costs and Labor

Materials consume a major portion of renovation budgets. Research options thoroughly - sometimes mid-range products offer nearly identical durability to premium brands. That luxury tile might look stunning, but will it withstand daily wear? Smart material choices balance aesthetics, functionality and budget realities.

Labor costs fluctuate based on project complexity and regional rates. While experienced contractors charge more, their expertise often prevents costly do-overs. Always verify necessary permits are included in labor quotes, and check references thoroughly before hiring.

Contingency Planning and Unexpected Expenses

Renovation surprises are inevitable - whether hidden water damage or unexpected structural issues. Allocate 10-15% of your total budget as a contingency fund. This financial cushion keeps stress levels manageable when (not if) unforeseen costs arise.

Project Timeline and Scheduling

Realistic scheduling prevents budget blowouts. Material delays, weather disruptions, or permit hiccups can stretch timelines. Work with your contractor to build buffer time into the schedule, especially for weather-dependent exterior work. Regular progress check-ins help catch potential overruns early.

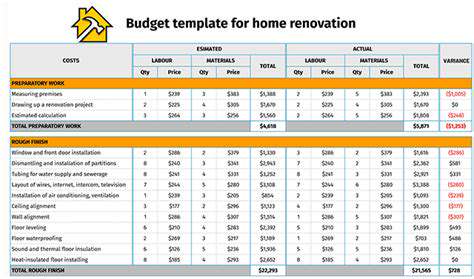

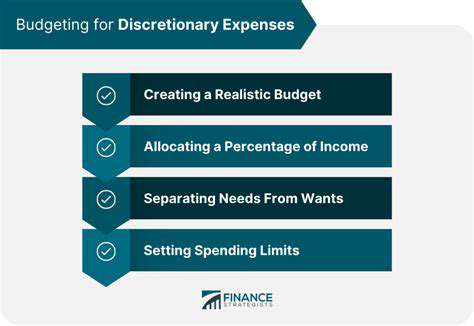

Crafting a Detailed Renovation Budget: Categorizing Expenses

Initial Assessment and Planning

Successful renovations begin with cold, hard facts. Document every inch of your current space - measure twice, budget once. Photograph existing conditions and create a detailed inventory of salvageable materials. This groundwork prevents costly measurement errors and helps contractors provide accurate quotes.

Be brutally honest about what you can afford. Factor in not just construction costs but temporary housing if needed, storage fees, and eating out during kitchen remodels. Underestimating living expenses during renovation is a common budget killer.

Material Cost Estimation

Material pricing requires detective work. Visit multiple suppliers with your exact specifications. Ask about price-matching policies and bulk purchase discounts. Remember to account for cutting waste - that beautiful hardwood flooring loses 10% to cuts and defects. Always buy slightly more than your measurements indicate.

Labor Cost Projections

Skilled tradespeople deserve fair pay, but costs vary wildly. Get at least three bids for each trade specialty, ensuring they're bidding on identical scopes of work. Beware of suspiciously low bids - they often signal inexperience or hidden costs waiting to emerge.

Permitting and Legal Fees

Cutting corners on permits risks costly fines or forced demolition. Research local requirements thoroughly - some jurisdictions require permits for minor work like fence replacements. Factor in not just permit fees but potential architectural or engineering review costs.

Contingency Planning

That pristine drywall might hide knob-and-tube wiring. The charming original floors could conceal asbestos. Assume you'll discover at least one expensive surprise, because renovation reality rarely matches Pinterest dreams. Your contingency fund is your financial safety net.

Financing Options

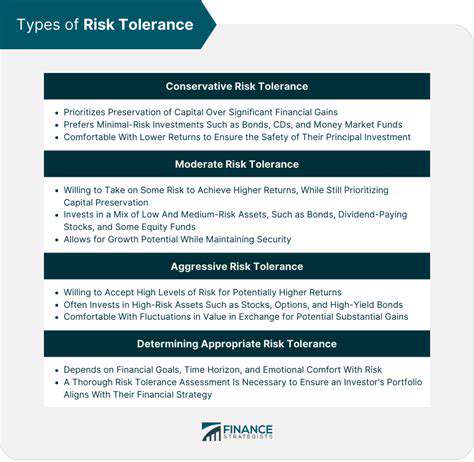

Loan terms dramatically impact total project costs. A lower monthly payment often means paying significantly more interest over time. Run the numbers for the entire loan term, not just the attractive introductory rate. Consider consulting a financial advisor before committing.

Budget Review and Adjustment

Treat your budget as a living document. Weekly expense tracking helps spot overages before they snowball. Be prepared to make tough choices - maybe those handcrafted Moroccan tiles wait for Phase Two when savings rebuild.

Many people find that sound machines significantly improve their ability to relax and sleep better. These devices do more than just reduce noise - they create an environment conducive to rest. By producing steady background sounds, these machines help mask disruptive noises from the environment. Research shows that consistent sound patterns can actually help synchronize our natural sleep cycles, leading to deeper, more restorative sleep. For those who struggle with anxiety or racing thoughts at bedtime, these devices can be particularly beneficial.

Managing Your Renovation Budget: Strategies for Staying Within Limits

Initial Planning and Assessment

Renovation budgets live or die in the planning stage. Create separate line items for demolition, construction, finishes, and incidentals. Underestimating dumpster rental fees or temporary storage costs has derailed many projects. Account for every screw and switchplate.

Defining Your Renovation Needs

Separate must-haves from nice-to-haves with military precision. That sunken bathtub might spark joy, but fixing the leaky roof prevents disaster. Prioritize structural and mechanical updates before cosmetic enhancements - drywall can wait until the wiring won't start fires.

Researching and Comparing Costs

Become a comparison shopping ninja. Many suppliers offer contractor discounts if you ask, even for DIY purchases. Consider gently-used or surplus materials - that $200/sqft marble might have a nearly identical $40/sqft remnant at a stone yard.

Creating a Detailed Budget

Your budget spreadsheet should have more tabs than a browser with ADHD. Track actual spending against estimates in real time - daily updates prevent nasty surprises. Color-code overages in red so they glare at you accusingly until addressed.

Managing Unexpected Costs

When (not if) surprises arise, stay calm and reassess. Maybe those custom cabinets get swapped for semi-custom to cover unexpected plumbing repairs. Having predetermined fallback options makes tough decisions easier when stress levels run high.

Utilizing Financing Options

Understand the true cost of borrowing. A 0% introductory rate that balloons to 29% after six months could undo all your budget discipline. Read every line of loan documents, especially the microscopic print about late fees and rate adjustments.

Tracking and Monitoring Expenses

Paper receipts disappear; digital records don't. Use budgeting apps that sync across devices so you always know your remaining balance. Snap photos of every purchase receipt immediately - that $2,500 plumbing invoice deserves its own folder.

Financing Your Renovation: Exploring Different Options

Understanding Your Budget

Before considering loans, scrutinize your existing finances. Calculate how much renovation debt you can service without sacrificing retirement contributions or emergency savings. Renovations should enhance your life, not become a financial noose.

Home Equity Loans

Tapping home equity makes sense for value-adding projects, but tread carefully. Borrowing against your house means the bank owns more of your future. Ensure projected renovation benefits outweigh the long-term interest costs.

Personal Loans

Unsecured loans work for smaller projects but carry higher rates. That quick kitchen refresh might justify 12% interest, but not a whole-house overhaul. Always run the numbers for total repayment amounts, not just monthly payments.

Credit Cards

Reserve plastic for emergencies only. That 29% APR turns a $5,000 appliance purchase into $6,450 if not paid immediately. If you must charge, use a card with 0% introductory APR and pay it off before rates spike.

Renovation Loans

Specialized renovation loans often offer better terms. Some programs even escrow funds and pay contractors directly, preventing misuse. Research whether your project qualifies for any energy-efficiency or historic preservation incentives.

Saving and Budgeting Strategies

Delayed gratification pays dividends. Waiting six months to accumulate cash might save five years of loan payments. Consider temporary sacrifices - that daily latte habit could fund your backsplash.

Seeking Professional Advice

A one-hour consultation with a financial planner could save thousands. They'll spot tax deductions or loan programs you might miss, like energy credit recapture strategies. Worth every penny of their fee.

Read more about How to Budget for Home Renovations

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![Best Homeowners Insurance Companies [2025 Review]](/static/images/30/2025-05/TopTierHomeownersInsuranceProvidersin2025.jpg)

![Best Budgeting Software for Families [2025]](/static/images/30/2025-05/EvaluatingPopularBudgetingSoftwareOptionsforFamilies.jpg)