How to Stay Motivated While Paying Off Debt Alone

Rewarding Yourself and Avoiding Burnout

Understanding the Importance of Rewards

Rewarding yourself is crucial for maintaining motivation throughout the debt payoff process. It's not about indulging in frivolous purchases, but about acknowledging and celebrating milestones. These rewards, whether small or large, reinforce positive behavior and help prevent the feeling of being perpetually trapped in a cycle of debt repayment. A system of rewards keeps you engaged and motivated to continue working towards your financial goals, making the journey more enjoyable and less daunting.

Small rewards can be as simple as a movie night, a new book, or a relaxing bath. Larger rewards, like a weekend getaway or a new piece of clothing, should be reserved for significant milestones, such as paying off a large chunk of debt or reaching a specific savings target. The key is to make the rewards meaningful and directly related to the effort you're putting in.

Setting Realistic and Achievable Goals

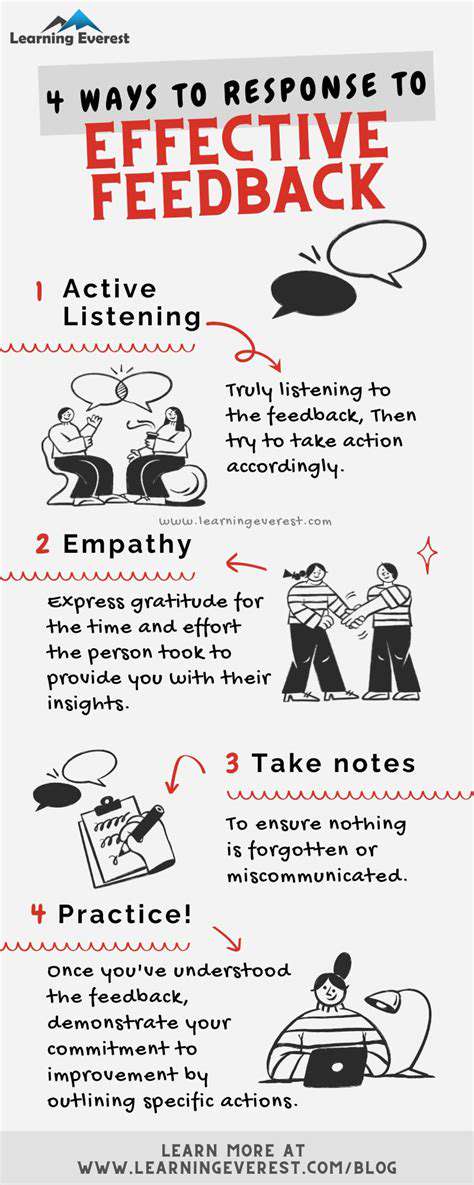

Setting realistic and achievable goals is fundamental to avoiding burnout and maintaining motivation. If your goals are overly ambitious or unattainable, you're likely to feel discouraged and lose your drive. Break down your debt repayment plan into smaller, manageable steps. This will allow you to celebrate progress along the way and build momentum towards your overall goal of debt freedom.

Instead of aiming for a complete debt payoff in a short time frame, focus on consistent, incremental progress. This approach fosters a sense of accomplishment and keeps you motivated rather than overwhelmed. Celebrate each step you take, no matter how small, to maintain a positive mindset and avoid the feeling of being stuck.

Prioritizing Self-Care and Mental Well-being

Prioritizing self-care and mental well-being is essential for avoiding burnout. The stress of managing debt can be significant, and neglecting your mental and physical health will only make the process harder. Make time for activities that help you relax and de-stress, such as exercise, meditation, spending time in nature, or engaging in hobbies.

Taking care of yourself is not a luxury, but a necessity. It allows you to approach your debt repayment journey with a more positive and resilient mindset. By maintaining a healthy balance between work and personal life, you can better manage stress and keep your motivation high throughout the process.

Creating a Support System

Building a strong support system can provide invaluable encouragement and guidance during the debt payoff journey. Sharing your goals and challenges with trusted friends, family members, or a support group can provide emotional support and practical advice.

Talking to someone about your struggles can help you feel less alone and more empowered. Having a support system also allows you to celebrate your successes together, amplifying the positive feelings and reinforcing your motivation to continue.

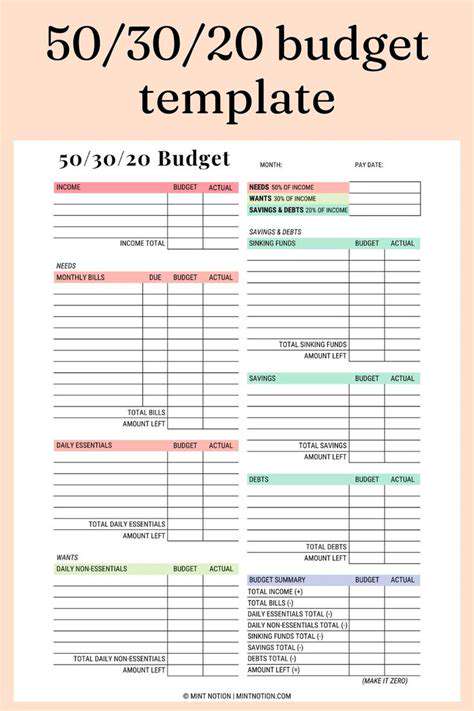

Establishing a Budget and Sticking to It

A well-defined budget is crucial for managing your finances effectively and staying on track with your debt repayment plan. Understanding your income and expenses will help you identify areas where you can cut back and allocate more funds towards debt reduction.

Budgeting provides a clear picture of your financial situation, allowing you to make informed decisions and avoid unnecessary spending. Sticking to your budget is key to reducing debt and improving your financial well-being. This, in turn, reduces financial stress, which is a major contributor to burnout.

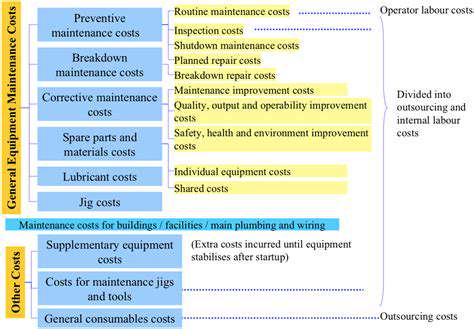

Identifying and Addressing Potential Challenges

Recognizing potential challenges and developing strategies to address them is essential for maintaining motivation and avoiding burnout. Unexpected expenses, job loss, or relationship issues can significantly impact your debt repayment plan. By anticipating these potential challenges, you can develop contingency plans to mitigate their impact.

Being prepared for setbacks will help you stay resilient and focused on your goals. This preparedness reduces the likelihood of feeling overwhelmed or discouraged, allowing you to continue your progress towards financial freedom. Addressing challenges head-on demonstrates your commitment to your financial well-being and helps maintain motivation.

Read more about How to Stay Motivated While Paying Off Debt Alone

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![Guide to Investing During Inflation [Strategies]](/static/images/30/2025-05/AdaptingYourInvestmentStrategyOverTime.jpg)

![How to Cut Unnecessary Expenses [Actionable Steps]](/static/images/30/2025-05/NegotiatingBillsandUtilizingDiscounts.jpg)