Passive Investing vs Active Investing

Expense ratio differences between passive and active strategies can significantly influence long-term returns. For instance, a $10,000 investment with a 0.50% expense ratio loses $50 annually to fees, while the same investment with a 0.10% ratio loses only $10. Over time, these differences compound, potentially creating substantial disparities in net returns.

The effect becomes more pronounced over longer periods. Persistent small variations in expense ratios can lead to significant differences in net returns after several years.

Expense Ratios and Portfolio Construction

When building a portfolio, investors should carefully evaluate the expense ratios of various investments. The choice between passive and active strategies should consider risk tolerance, investment objectives, and a clear understanding of how expense ratios affect long-term returns. A well-designed portfolio balances risk and reward while minimizing unnecessary fees.

Expense Ratio Transparency and Investor Due Diligence

Transparency in expense ratios is essential for informed decision-making. Investment firms should clearly disclose all fees and expenses associated with their funds. Thorough research and due diligence are necessary to compare expense ratios across options, understand their impact on returns, and select the best fit for individual financial goals.

Investors should look beyond advertised returns and scrutinize expense ratios to fully comprehend an investment's true cost and its long-term effect on returns. This careful analysis is crucial for lasting financial success.

Risk Tolerance and Investment Horizon

Understanding Risk Tolerance

Risk tolerance is a personal and critical factor in investment decisions. It involves understanding one's comfort level with potential losses rather than avoiding risk altogether. Investors with high risk tolerance may prefer volatile investments like stocks, seeking higher returns while accepting greater portfolio fluctuations. Conversely, those with low risk tolerance might favor safer options like bonds, prioritizing capital preservation over aggressive growth.

Factors influencing risk tolerance include age, financial objectives, and personal circumstances. Younger investors with longer horizons often tolerate higher risk, having more time to recover from market downturns. Those nearing retirement may prioritize capital preservation, opting for lower-risk investments to secure future income.

Defining Investment Horizon

Investment horizon refers to the planned duration for holding investments. Short horizons, such as saving for a house down payment in five years, require different strategies than long horizons like retirement planning decades away. Longer horizons allow for higher-growth investments but necessitate diversified portfolios to manage extended risk.

Shorter horizons often call for more conservative investments prioritizing security and stability, minimizing the risk of significant losses from market fluctuations.

Impact of Risk Tolerance on Investment Strategy

Risk tolerance directly shapes investment strategy. High tolerance may lead to stock-heavy portfolios seeking higher returns despite volatility. Low tolerance might result in bond-dominated portfolios emphasizing capital preservation. Understanding risk tolerance enables the creation of strategies aligned with goals and comfort levels.

Effective strategies balance risk and reward, considering both investment horizon and personal risk tolerance. Tailored approaches often yield the best long-term outcomes.

Matching Investment Horizon with Risk Tolerance

Successful strategies align investment horizons with risk tolerance. For example, young investors with long horizons might comfortably pursue higher-risk, higher-return investments like stocks. Retirees with short horizons may prefer lower-risk, stable investments like bonds to preserve capital for immediate needs.

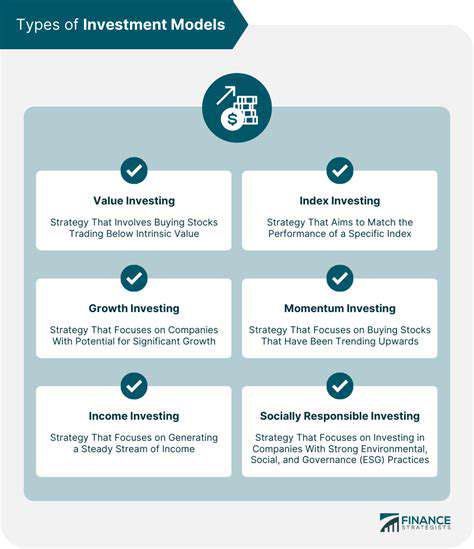

Active Investing Strategies and Risk Tolerance

Active strategies often require confidence in predicting market movements and typically suit higher risk tolerances. These approaches involve stock picking, market timing, and other calculated risks to potentially outperform the market.

Understanding risk tolerance is paramount in active investing. Active investors generally exhibit higher risk tolerance than passive investors. Awareness of potential significant losses associated with these strategies is crucial.

Passive Investing and Risk Tolerance

Passive investors usually adopt more diversified approaches, mirroring market indices. This often aligns with moderate to lower risk tolerance, as diversification helps mitigate losses from individual stock fluctuations. Passive investing emphasizes broad market participation, suitable for those with lower tolerance for individual security risk.

Passive investing typically requires less active management, benefiting investors with lower risk tolerance or limited time/expertise for portfolio management.

The Role of Diversification in Risk Management

Regardless of strategy (active or passive), diversification is critical for risk management. Spreading investments across asset classes, industries, and geographies helps mitigate losses in any single area. This is especially important for lower risk tolerance investors, protecting capital from significant sector downturns.

Diversification in any investment approach is vital for managing risk and achieving long-term financial goals. It minimizes market volatility impact and preserves capital for those with lower risk tolerance.

The Role of Diversification in Both Approaches

Diversification in Passive Investing

Passive strategies like index funds and ETFs emphasize broad market exposure. This inherent diversification is fundamental to the approach. By holding numerous securities across sectors and market capitalizations, passive investors reduce exposure to individual company risk. This strategy assumes overall market growth over time, with diversification smoothing short-term fluctuations for more consistent returns.

A key passive diversification benefit is relatively low cost. These funds' lack of active management typically results in lower expense ratios than actively managed funds. Lower costs directly enhance long-term returns, especially when compounded over time. This is crucial in passive strategies, focusing on fee minimization and return maximization through broad diversification advantages.

Diversification in Active Investing

Active investors aim to outperform markets. Diversification remains important but is applied more selectively. Instead of mirroring broad indices, active managers identify undervalued companies/sectors while potentially avoiding overvalued ones. This requires well-researched, carefully constructed portfolios where diversification strategically mitigates risks tied to specific investment theses.

While active funds may hold various stocks and bonds, their diversification focuses on strategic capital allocation across asset classes, sectors, and geographies to capture unique opportunities and mitigate strategy-specific risks. This selective approach demands thorough market understanding and active management.

The Importance of Sector Diversification

In both strategies, sector diversification is vital. Passive investors benefit from broad sector representation within indices. Active investors can refine this by selecting investments across sectors based on analysis, capitalizing on sector strengths while mitigating weaknesses. This proves particularly valuable during economic uncertainty or sector-specific volatility.

Geographic Diversification for Reduced Risk

Geographic diversification is another key element in both approaches. Passive investors gain from international holdings in broad indices. Active investors can strategically allocate to emerging or developed markets, aiming to maximize returns while spreading risk across different economies and political landscapes. Understanding regional risks and opportunities is essential for globally diversified portfolios.

The Impact of Diversification on Risk Tolerance

Diversification degree directly affects portfolio risk tolerance. Passive investors typically have lower tolerance due to index funds' inherent diversification. Active investors can adjust tolerance through careful investment selection within diversified portfolios. Well-diversified portfolios, regardless of approach, provide peace of mind by spreading investments across various assets, reducing the impact of any single investment's poor performance.

Read more about Passive Investing vs Active Investing

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![How to Create a Monthly Budget That Works [2025 Guide]](/static/images/30/2025-05/ReviewingandRevisingYourBudgetRegularlyforLong-TermFinancialStability.jpg)