Understanding Gift Taxes

Understanding the Annual Gift Tax Exclusion

The annual gift tax exclusion is a crucial component of understanding gift taxes. It allows individuals to give a certain amount of money or property to others each year without incurring gift tax liability. This exclusion is a significant benefit for families and individuals who want to transfer assets to loved ones or charitable organizations without facing immediate tax implications. Understanding its limits and application is vital to avoid potential tax complications.

This exemption, established by the IRS, is a valuable tool for estate planning and wealth transfer. It provides significant flexibility in transferring assets between generations, allowing for more efficient and less burdensome transitions, especially when compared to other methods like outright gifts.

Calculating the Gift Tax Exclusion

The annual gift tax exclusion amount is a fixed figure set by the IRS each year. This amount doesn't change significantly from year to year and represents the maximum amount you can gift to a single recipient without triggering gift tax. It's essential to keep track of this limit to ensure compliance with the tax laws and avoid any unexpected tax burdens.

The current annual gift tax exclusion amount is a crucial number to know and understand. Knowing this number allows individuals to plan their gifting strategies effectively, ensuring they remain within the legal limits and avoid potential tax issues. It's always recommended to consult with a qualified tax professional for personalized guidance on calculating and applying the exclusion in specific circumstances.

Gift Tax Exclusion and Multiple Recipients

The annual gift tax exclusion applies per recipient. This means that if you're gifting to multiple individuals, you can still use the exclusion amount for each recipient, but the total amount given to all recipients cannot exceed the applicable annual exclusion limit. Understanding this aspect is important to avoid exceeding the limit and triggering potential gift tax liabilities.

Planning gifts to multiple recipients requires careful consideration and record-keeping. It's vital to maintain accurate records of all gifts made throughout the year to ensure compliance with gift tax regulations. This meticulous record-keeping can prevent confusion and potential issues during tax time.

Exclusions for Charitable Donations

Charitable donations are treated differently under the gift tax rules. In many cases, charitable gifts may not be subject to the annual gift tax exclusion limits. The rules for charitable donations are complex and can vary greatly depending on the type of organization and the nature of the donation. It's vital to understand these intricacies to ensure your charitable giving complies with the law.

Donating to qualified charities can be a significant part of an individual's philanthropic strategy. Understanding the specific rules and regulations surrounding charitable donations, including those related to the annual exclusion, is crucial for ensuring compliance and maximizing the effectiveness of your charitable giving.

Gift Tax Exclusion and Estate Planning

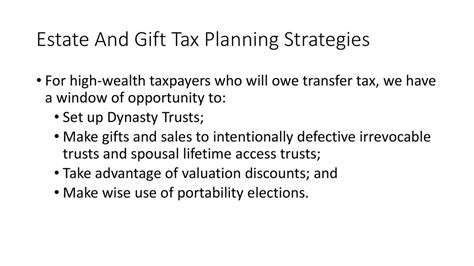

The annual gift tax exclusion is a significant tool in estate planning. It allows individuals to make gifts during their lifetime without incurring immediate gift tax, which can reduce the size of the estate that is subject to estate tax upon death. Careful planning is essential to utilize this exclusion effectively to minimize the overall tax burden on the estate.

This component of estate planning is complex, and individuals should consult with qualified legal and tax professionals to create a strategy that aligns with their specific needs and goals. Proper use of the exclusion can reduce the tax burden on heirs and ensure a more straightforward transition of assets.

Gift Tax vs. Estate Tax: Key Differences and Overlaps

Gift Tax

The gift tax is a tax levied on the transfer of wealth from one person to another, typically during one's lifetime. It's an important consideration for individuals seeking to avoid or minimize estate tax liabilities in the future. Understanding the gift tax rules is crucial for strategic estate planning. It's a crucial tool in estate planning and helps mitigate the tax burden on heirs. This tax applies to various types of gifts, including cash, property, and other assets.

There's an annual gift tax exclusion set by the IRS that allows individuals to give a certain amount of money each year without incurring gift tax. However, exceeding this exclusion over time can lead to substantial tax implications for the donor. It's essential to consult with a financial advisor or estate attorney to understand the specific limits and calculate the tax implications of your gifts. The annual exclusion amount is adjusted each year for inflation, ensuring that it remains relevant over time. This annual exclusion is vital for individuals making regular gifts to family or charitable organizations.

Estate Tax

The estate tax, on the other hand, is a tax levied on the transfer of wealth upon the death of an individual. It applies to the entire estate, encompassing all assets owned by the deceased. Calculating the tax owed is a complex process, often requiring expert assistance. The estate tax is designed to ensure that wealth transfers are fairly taxed to provide revenue for government services.

Estate taxes are levied on the total value of an individual's assets, including real estate, stocks, bonds, and other financial holdings. The tax rates and exemptions vary depending on the laws of the jurisdiction and the size of the estate. Navigating the estate tax implications can be challenging, and it's important to seek professional advice to ensure compliance and minimize tax liability.

There are often complexities in determining the value of assets, and understanding the applicable tax rates and exemptions can be challenging. This necessitates professional guidance to ensure accurate calculation and reporting of estate taxes. Proper planning can help reduce estate tax burdens for both the executor and the beneficiaries.

Key Differences

While both gift and estate taxes concern the transfer of wealth, they differ significantly in timing. Gift tax applies during the donor's lifetime, while estate tax applies upon death. This crucial distinction underpins the strategic approach to minimizing tax liabilities in estate planning. Careful planning can mitigate the impact of both taxes.

Furthermore, gift taxes have annual exclusion limits, allowing for certain gifts without immediate tax implications. Estate taxes, however, cover the entirety of the estate's value. Understanding these differences is essential to developing a comprehensive estate plan that accounts for both present and future tax liabilities. This nuanced approach is critical to minimizing the tax burden on both the donor and the recipient.

Another key difference lies in the reporting requirements. Gift tax reporting is often less complex than estate tax reporting, which can involve intricate valuations and documentation of assets. The complexities of estate tax reporting further underscore the importance of professional guidance in navigating these legal requirements.

Read more about Understanding Gift Taxes

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt