Guide to Investing in Index Funds

What are Index Funds?

Understanding the Basics

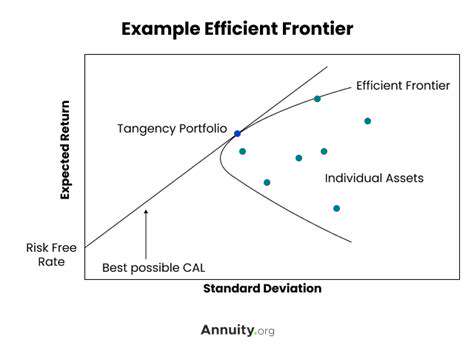

Index funds are investment vehicles that track a specific market index, such as the S&P 500 or the Nasdaq Composite. This means the fund's portfolio mirrors the holdings of the index it's designed to follow. Fund managers aim to replicate the index's performance as closely as possible, minimizing costs and maximizing returns aligned with the overall market. The core concept is passive investment, relying on the broad market's performance rather than active stock picking.

A key characteristic of index funds is their diversification. By investing in a large number of stocks, bonds, or other assets, index funds spread risk across a wide range of holdings. This diversification is a crucial element in mitigating potential losses from individual investment failures.

Passive vs. Active Investment Strategies

Unlike actively managed funds where fund managers try to outperform the market through stock selection, index funds employ a passive strategy. This means they don't attempt to pick individual stocks that they believe will perform better than others. Instead, they simply replicate the holdings of the relevant index, which aims to provide broad market exposure.

This passive approach often results in lower management fees compared to actively managed funds. This is a significant advantage for investors seeking cost-effective ways to participate in the market's growth.

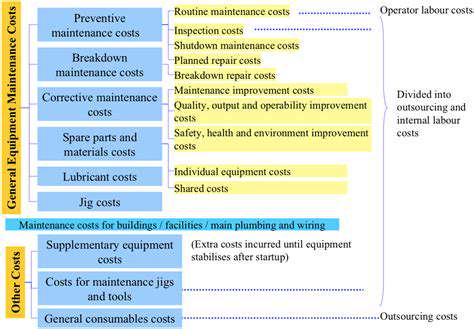

Expense Ratios and Fees

Expense ratios are crucial to understanding the cost of investing in an index fund. These fees are typically low, often less than 0.1%, making index funds an attractive option for long-term investors seeking low-cost market exposure. Understanding and comparing expense ratios across different index funds is essential for making informed investment decisions.

Comparatively low expense ratios are key to maximizing returns over the long term. Fund investors should consider these ratios when evaluating different index funds.

Tax Implications and Diversification

Index funds, due to their broad market exposure, can offer significant tax advantages. The diversification inherent in index funds helps to reduce the impact of individual stock price fluctuations. This is particularly important in times of market volatility.

Tax implications vary based on individual investor circumstances. It's important to consult with a qualified financial advisor to understand how these implications relate to your personal financial situation.

Types of Index Funds

There are various types of index funds, categorized by the specific index they track. These funds can track large-cap, small-cap, or mid-cap stocks, as well as specific sectors like technology or healthcare. Investors can target specific market segments or investment goals by selecting appropriate index funds.

This wide range of options allows investors to tailor their investments to their particular risk tolerance, financial goals, and investment time horizons. Different market segments have varying levels of risk and return potential. Understanding these nuances helps investors make informed choices.

Selecting the Right Index Fund

Several factors are important when choosing an index fund. Investment objectives, risk tolerance, and financial goals are crucial considerations. Carefully evaluating expense ratios and understanding the fund's tracking error is also vital. Investors should seek professional guidance to help them choose an index fund that aligns with their individual circumstances.

Thorough research and consultation with a financial advisor are essential for making informed decisions about which index fund best suits your investment strategy.

Read more about Guide to Investing in Index Funds

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![Best Life Insurance Policies [2025 Review]](/static/images/30/2025-05/AssessingPermanentLifeInsuranceOptions.jpg)