Understanding Portfolio Theory

The Efficient Frontier and Optimal Portfolios

Understanding the Core Concept

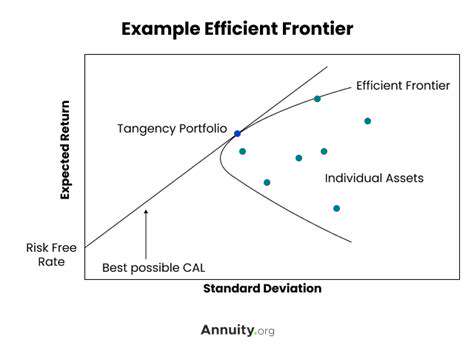

In investment circles, the efficient frontier stands as a fundamental principle of portfolio management theory. This graphical model demonstrates how various investment combinations relate to risk and potential returns. Essentially, it maps out portfolios that deliver maximum returns for specific risk levels or minimal risk for targeted return expectations. This visualization helps investors pinpoint strategies that align perfectly with their comfort with risk and financial aspirations.

Grasping this concept proves invaluable for those aiming to create investment mixes that smartly weigh potential gains against possible losses. The frontier's visual nature makes the risk-reward tradeoff immediately apparent, empowering investors to allocate assets with greater confidence.

Factors Influencing the Shape of the Frontier

Multiple elements determine how the efficient frontier appears and where it sits on the risk-return spectrum. These include how different assets move in relation to each other, their anticipated performance, and current risk-free investment rates. When assets show strong positive correlation, combining them offers limited advantage in spreading risk.

The risk-free rate acts as a crucial reference point for evaluating all other investment options. When this baseline rate increases, the entire frontier typically shifts upward, indicating more favorable conditions for investors. Similarly, assets with higher expected returns naturally push the frontier's upper boundary outward.

Portfolio Diversification and the Frontier

Smart diversification forms the backbone of sound portfolio construction, and the efficient frontier clearly demonstrates its benefits. By carefully selecting assets that don't move in lockstep, investors can meaningfully reduce risk without necessarily sacrificing returns. This strategy works because different investments respond differently to market conditions, preventing any single underperformer from dragging down the entire portfolio.

The frontier's curve specifically identifies those portfolio combinations that deliver peak performance for given risk parameters. Investors can use this information to select investment mixes that best match their personal financial objectives and risk appetite.

Constructing an Optimal Portfolio

The efficient frontier enables investors to tailor their portfolios according to individual preferences. Those comfortable with greater uncertainty might choose positions further along the curve, accepting higher volatility for potentially greater rewards. More cautious investors typically prefer positions nearer the risk-free rate, prioritizing stability over maximum returns. This personalized approach ensures each investor's portfolio reflects their unique financial situation and goals.

Mastering efficient frontier concepts allows investors to make more informed choices. This knowledge helps create investment strategies that properly balance risk and potential gains while staying true to personal financial circumstances.

Practical Applications and Considerations

Diversification Strategies in Action

Diversification remains central to modern investment theory, working to reduce risk through broad exposure across different investment categories. Effective implementation involves selecting equities from diverse industries, bonds with staggered maturity dates, property investments, and sometimes alternative assets like commodities. A properly diversified portfolio acts as a buffer against volatility in any single market segment, creating more consistent performance over time.

Successful diversification requires understanding how different investments interact. Securities within the same sector often move similarly, providing minimal risk reduction. Careful study of historical patterns and potential future relationships proves essential for building portfolios that truly mitigate risk.

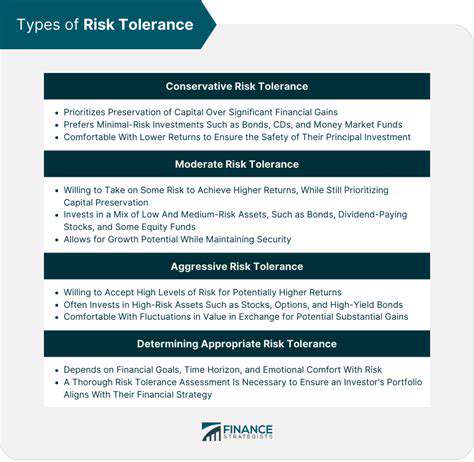

Assessing Risk Tolerance and Investment Goals

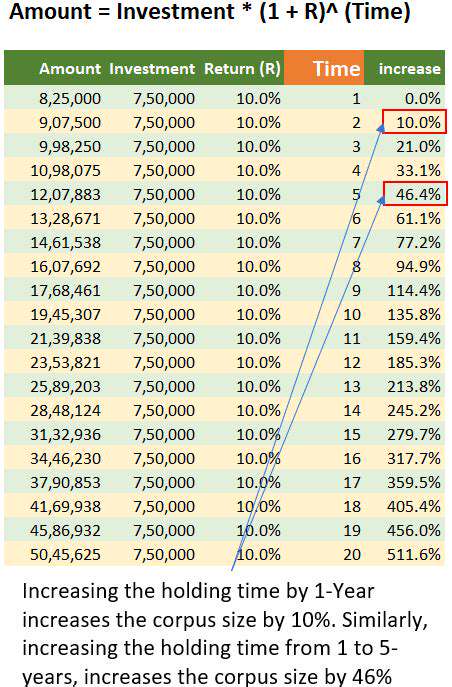

Establishing personal risk parameters represents a critical first step in portfolio construction. How much short-term fluctuation can you comfortably endure? Are you investing for immediate needs or long-term objectives like retirement? Typically, younger investors with extended time horizons can weather more volatility, while those nearer to needing their funds often prefer stability.

Clearly defined financial targets should guide investment decisions. Whether saving for education, retirement, or major purchases, specific goals help determine appropriate asset selection. An honest evaluation of both risk capacity and financial objectives forms the foundation for creating a portfolio that truly serves your needs.

The Role of Asset Allocation

Asset allocation involves distributing investments across different categories like stocks, bonds, and cash instruments. The ideal mix depends entirely on personal factors including risk tolerance, investment timeline, and financial targets. Growth-oriented portfolios typically emphasize equities, while capital preservation strategies favor more stable fixed-income investments.

Importance of Regular Portfolio Rebalancing

Market movements constantly alter portfolio compositions. Periodic rebalancing returns investments to their intended allocations, maintaining desired risk levels and potentially enhancing long-term performance. This disciplined approach helps investors stick to their strategic vision through changing market conditions.

Evaluating Portfolio Performance and Adjustments

Consistent performance review remains essential for investment success. Tracking metrics like returns, volatility, and diversification effectiveness shows whether your strategy meets expectations. Significant deviations from plan or major market shifts may require tactical adjustments to stay aligned with your financial roadmap.

The Impact of Taxes and Fees on Returns

Investment gains can be substantially affected by tax consequences and management costs. Understanding these factors helps maximize net returns, as excessive fees and taxes can dramatically reduce overall performance. Smart investors factor these considerations into all investment decisions.

Understanding Market Cycles and Economic Conditions

Economic fluctuations significantly influence investment outcomes. Recessions, inflationary periods, and other macroeconomic changes affect asset classes differently. Recognizing these patterns and their potential impact allows for proactive portfolio adjustments. Staying informed about economic developments helps investors navigate changing financial landscapes effectively.

Read more about Understanding Portfolio Theory

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![Best Tools for Debt Management [2025]](/static/images/30/2025-05/DebtManagementPlans28DMPs293APersonalizedStrategiesforRepayment.jpg)

![Best Health Insurance Plans for Families [2025]](/static/images/30/2025-05/EvaluatingCoverageandBenefits.jpg)