How to Use the Debt Roll Up Method

The Process of Securing a Debt Roll-Up Loan

Understanding the Debt Rollover Process

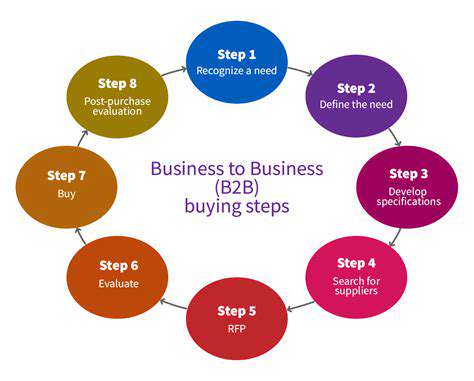

A debt rollover, also known as debt refinancing, involves replacing an existing debt with a new one, often with different terms. This process can be complex and should be approached with careful consideration. Understanding the intricate details of the rollover process is crucial for making informed decisions. This involves evaluating the new loan terms, including interest rates, repayment schedules, and fees. It's important to compare these terms to your current debt obligations.

Often, a debt rollover aims to improve the borrower's financial situation, such as lowering interest rates or extending the repayment period. However, it's not a guaranteed solution, and potential risks need to be considered before embarking on this process. It's essential to consult with a financial advisor to discuss your specific financial circumstances and determine if a debt rollover is suitable for your needs.

Assessing Your Current Debt Situation

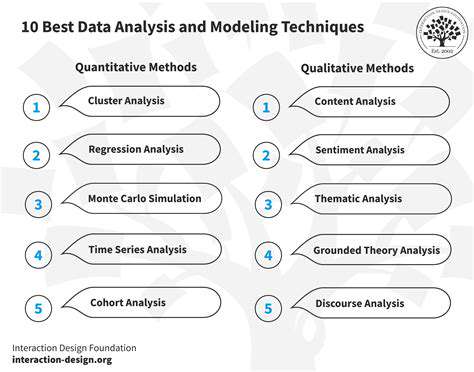

Before engaging in a debt rollover, a thorough assessment of your current debt is paramount. This includes evaluating the outstanding balance, interest rates, and repayment terms of each existing loan. Accurate data analysis is critical for making the right choice during the rollover process. This process can be time-consuming, but it's essential for a successful outcome.

Identifying areas for potential savings, such as negotiating lower interest rates or consolidating multiple debts into one, is vital. A clear understanding of your current financial position is the first step towards a successful debt rollover.

Evaluating the New Loan Terms

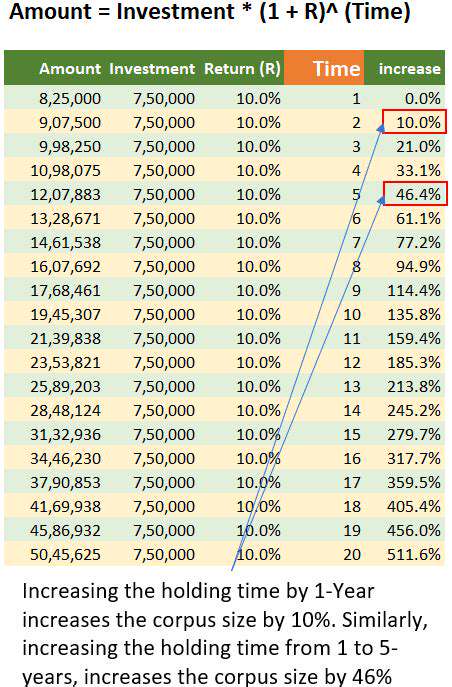

Careful consideration of the new loan terms offered during a debt rollover is essential. This involves a comprehensive comparison of interest rates, repayment schedules, and associated fees. The interest rate is a primary factor to consider, as it directly impacts the total cost of the loan. Understanding how the repayment schedule will affect your monthly budget is also important. Fees associated with the new loan, such as origination fees, should be thoroughly evaluated to avoid any hidden costs.

Negotiating with Lenders

Negotiating with lenders for favorable terms during a debt rollover can be a complex process. Effective communication and a clear understanding of your financial situation are crucial for success. Demonstrating a strong understanding of the rollover process and your commitment to repayment are key factors that lenders consider.

Considering the Risks and Rewards

Debt rollovers, while potentially beneficial, come with certain risks. These risks may include the possibility of higher fees, stricter repayment terms, or even a failure to lower the overall debt burden. Thorough research and careful consideration of all factors are crucial before proceeding. Weighing the potential benefits against the risks is essential for a sound decision.

The rewards of a successful debt rollover can be significant, such as lower monthly payments or a reduction in overall interest paid over time. However, a poorly executed rollover can lead to a more difficult financial situation. Understanding the potential risks and rewards is essential for making an informed decision.

Seeking Professional Advice

Before making any decisions regarding a debt rollover, seeking professional financial advice is highly recommended. A financial advisor can provide personalized guidance, assess your specific circumstances, and help you navigate the complexities of the process. An expert can help you make informed decisions based on your individual financial situation. They can provide a broader perspective on the potential benefits and drawbacks of the rollover.

Read more about How to Use the Debt Roll Up Method

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![Best Life Insurance Policies [2025 Review]](/static/images/30/2025-05/AssessingPermanentLifeInsuranceOptions.jpg)

![Best Tools for Debt Management [2025]](/static/images/30/2025-05/DebtManagementPlans28DMPs293APersonalizedStrategiesforRepayment.jpg)