Tips for Lowering Your Homeowners Insurance Premiums

Boosting Your Home's Safety Profile for Lower Premiums

Improving Exterior Security

A strong exterior security system is crucial for protecting your home from intruders. Investing in sturdy doors and windows with reinforced frames and locks is a fundamental step. Consider installing security cameras or motion detectors to deter potential burglars and provide visual alerts. These measures, coupled with a well-lit exterior, create a hostile environment for criminals, increasing the overall safety profile of your home.

Furthermore, regularly inspecting and maintaining your security systems is vital. This includes checking the functionality of locks, lights, and alarms, ensuring they are in proper working order. A proactive approach like this will significantly reduce the risk of security breaches and enhance the peace of mind you enjoy in your home.

Enhancing Interior Safety Features

Protecting your family inside the home is equally important. Installing smoke detectors on every level, and carbon monoxide detectors, is a fundamental safety measure. These devices can alert you to potential hazards, giving you crucial time to react and prevent serious incidents. Regularly testing these devices to ensure they are functioning properly is equally crucial.

Consider installing childproof locks on cabinets containing cleaning supplies or medications. This simple measure can prevent accidents and keep your loved ones safe. Securely storing potentially hazardous materials in a safe, out-of-reach location is another smart measure.

Implementing Smart Home Technology

Smart home technology offers a range of safety enhancements. Smart locks, monitored by a smartphone app, allow you to control access to your home remotely. This feature provides enhanced security and convenience for managing who enters and exits your property, making it a valuable addition to any home security system.

Smart security cameras offer 24/7 surveillance, providing real-time alerts and footage for peace of mind. Integration with other smart devices, like lighting systems, can create an impression of occupancy even when you are away, further deterring potential intruders.

Creating a Safe Environment for Children

Protecting children from potential hazards within the home is paramount. Installing safety gates on stairs and covering electrical outlets are crucial steps in creating a safe environment for young children. These simple measures can prevent accidents and injuries, ensuring a secure and happy home for your little ones.

Ensuring that potentially hazardous items are stored securely and out of reach is also a key consideration. Regularly inspecting the home for potential dangers and addressing them promptly can greatly reduce the risk of accidents occurring.

Utilizing Landscaping for Enhanced Security

Landscaping plays a significant role in bolstering your home's security profile. Strategic planting can create visual barriers, obscuring the view of your home's exterior and making it more challenging for potential intruders to approach undetected. Dense shrubs or hedges can be strategically placed to provide natural screening, offering an extra layer of security.

Well-maintained landscaping also contributes to the overall aesthetic appeal of your home, enhancing its curb appeal, and deterring unwelcome visitors. Proper lighting in the yard, particularly around entry points, can also contribute to a more secure environment.

Leveraging Discounts and Bundling for Insurance Savings

Understanding Discount Opportunities

Discounts for home insurance can often be overlooked, but they can represent significant savings. Understanding the various factors that insurers consider for discounts, like security systems, fire detectors, and even the age of your home, can unlock potential savings. Many insurers offer discounts for multiple policies, such as bundling your home and auto insurance, and this can be a powerful tool to lower your overall insurance costs. Investigating these opportunities is crucial for maximizing your potential savings.

Researching specific discounts available in your area is a valuable step to take. Different insurers have varying discount structures, and exploring these options allows you to compare and contrast the specific discounts offered by different providers. This proactive approach can lead to substantial cost reductions that you might otherwise miss.

Bundling Your Policies for Maximum Savings

Bundling your home insurance with other policies, such as auto insurance or renters insurance, can result in substantial savings. Insurers often offer a discount for customers who carry multiple policies with them. This is because maintaining multiple policies with a single provider reduces their administrative costs, allowing them to pass some of these savings on to you. This strategy can be very effective in maximizing your insurance savings and is worth exploring.

Bundling is a simple, yet often overlooked, strategy to save money on your home insurance. By consolidating your insurance needs under one provider, you can often secure a lower overall premium. This is a worthwhile strategy to consider as it can directly impact the amount you pay for your insurance policies.

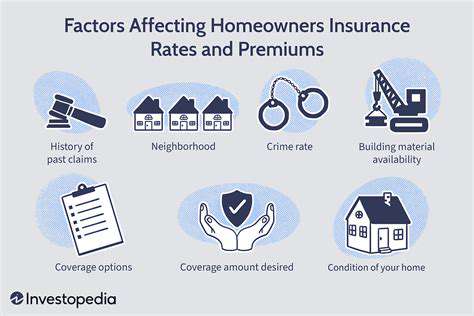

Analyzing Your Home's Security Features

Home security features often play a significant role in determining your insurance premium. Installing or upgrading security systems, including alarm systems and surveillance cameras, can often qualify you for substantial discounts. These features can lower the risk of property damage or theft, making your home less of a target for criminals and thus potentially lowering your insurance costs.

Insurers often assess the overall security measures of your property when determining your premium. This might include things like the quality of your locks, the presence of security lighting, or even the presence of a monitored alarm system. Understanding how these security features affect your premium is a key component to maximizing savings.

Evaluating Your Claim History

A clean claim history is a significant factor in securing favorable insurance rates. Minimizing incidents that require insurance coverage is crucial for maintaining a low premium. Avoiding unnecessary claims can demonstrably impact the overall cost of your home insurance. The fewer claims you make, the better your chances of securing favorable rates. This is a key aspect of responsible insurance management.

Investigating Discounts Based on Location

Your home's location can sometimes impact your insurance premium, and insurers often offer location-based discounts. This may be related to factors like the area's crime rate or the susceptibility of your area to natural disasters. Understanding these factors can help you identify potentially lucrative discounts. This can be a valuable strategy to identify savings.

Comparing Different Insurance Providers

Comparing quotes from multiple insurance providers is critical to finding the best possible rates. Different insurers have different pricing structures and discount programs, so comparing their offerings can yield significant savings. By exploring various options, you gain a broader perspective on your available choices. This is a straightforward yet highly effective way to reduce your insurance costs.

Understanding Insurance Policy Details

Carefully reading and understanding the terms and conditions of your home insurance policy is essential. Policies often include specific clauses that can affect your premium and the coverage you receive. Understanding your policy details empowers you to make informed decisions about your insurance needs and potential savings. This empowers you to control and manage your insurance costs.

Reviewing Your Coverage and Policy for Optimization

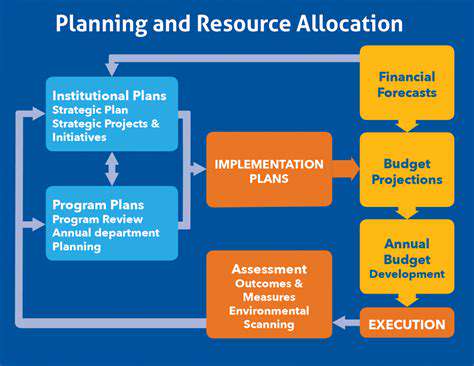

Reviewing Your Coverage

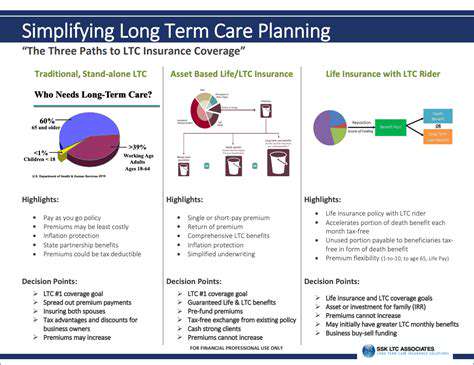

A crucial aspect of maintaining a robust and effective insurance policy is regularly reviewing its coverage. This proactive approach ensures that your policy accurately reflects your current needs and circumstances. Understanding the specifics of your coverage is paramount to making informed decisions about your financial security. This review process should encompass all aspects of your policy, from the types of risks covered to the limits of liability.

By reviewing your coverage, you can identify potential gaps or areas where your protection might be inadequate. This allows for adjustments to be made, ensuring that you are adequately protected against unforeseen events. For example, if you have recently purchased a new vehicle or significantly upgraded your home, your policy may need to be updated accordingly.

Understanding Your Policy

A comprehensive understanding of your insurance policy is essential for maximizing its benefits. This involves more than just reading the policy document; it requires a careful analysis to grasp the nuances and limitations. Thorough comprehension of your policy terms and conditions is essential to avoid any surprises or misunderstandings later on.

It's important to understand the specific types of risks covered, the limits of liability, and any exclusions. By having a clear understanding of these aspects, you can proactively protect yourself from financial losses.

Policy Modifications and Renewals

Regularly reviewing your policy allows you to identify necessary modifications. This may include adjustments to coverage limits, additions for new assets, or changes based on life events such as marriage, birth of a child, or relocation. Reviewing your policy before renewal is crucial, as this allows you to understand if the existing coverage still aligns with your current needs and circumstances.

This proactive approach to policy renewal is vital for maintaining appropriate financial protection. Furthermore, understanding the renewal process allows you to make informed decisions about your insurance choices and potentially secure more favorable rates.

Assessing Risk Factors

Evaluating your personal risk factors is critical to determining the optimal coverage for your needs. This involves considering factors such as your profession, location, and lifestyle. For instance, a construction worker might require a different level of coverage than a stay-at-home parent.

Reviewing Coverage Limits

Evaluating your coverage limits is a vital component of policy review. This involves assessing whether the current coverage limits are sufficient to address potential losses or damages. Understanding your coverage limits is essential for making informed decisions about your financial security.

Identifying Policy Gaps

Identifying potential policy gaps is another important aspect of the review process. This involves scrutinizing the policy to detect any areas where your protection might be insufficient. A thorough examination for gaps in coverage can help mitigate potential financial risks. This could involve situations such as insufficient coverage for valuable possessions, inadequate liability protection, or missing coverage for specific perils.

Communicating with Your Insurer

Regular communication with your insurance provider is crucial for maintaining an up-to-date and comprehensive policy. This includes promptly reporting any changes in your circumstances, such as a new home purchase, or asking questions about policy provisions that you do not fully understand. Open communication can help to ensure you have the best possible coverage and avoid costly surprises down the road.

Exploring Different Insurance Providers

Understanding Your Needs

When evaluating different insurance providers, it's crucial to understand your specific needs and the coverage you require. A comprehensive analysis of your home's features, location, and personal circumstances will help you identify the most suitable policy. This includes factors like the value of your home, the presence of high-risk features like a pool or a detached garage, and your personal preferences for coverage limits and deductibles.

Comparing Policy Costs

Don't just focus on the initial premium. Compare the total cost of the policy over a longer period, including potential increases in premiums and any extra fees. Thorough research and comparison shopping are essential to ensure you're not just paying for the lowest upfront cost, but also for the most comprehensive and affordable coverage in the long run. This means reviewing policy terms, exclusions, and potential add-ons.

Evaluating Coverage Options

Different insurance providers offer various coverage options. Carefully review the details of each policy, comparing the extent of coverage for dwelling, personal property, liability, and additional living expenses. Some providers may offer specialized coverage for unique risks, such as flooding, earthquakes, or high-value items. Understanding what's included and what's excluded will help you make an informed decision.

Analyzing Deductibles and Premiums

Deductibles and premiums are key factors in your overall insurance costs. A higher deductible often translates to a lower premium, but you need to be prepared for the financial responsibility if a claim occurs. Conversely, a lower deductible will increase your premium but provides greater financial security in the event of a loss. Consider your financial situation and risk tolerance when evaluating these important aspects of a policy.

Reviewing Claims Processes

Investigate how each provider handles claims. A streamlined and efficient claims process is crucial if you ever need to file a claim. Read reviews and testimonials, and look for providers with a reputation for responsive and helpful customer service. Knowing the steps involved in filing a claim and the typical turnaround time can provide crucial peace of mind.

Considering Customer Service and Reputation

The customer service provided by an insurance provider is just as important as the policy itself. Look for providers with positive customer reviews and a strong reputation for handling claims fairly and efficiently. Reading online reviews and contacting the provider directly to ask questions can give you valuable insight into their customer service practices. A responsive and helpful customer service team can be invaluable if you ever need to interact with the provider regarding your policy.

Assessing Company Financial Stability

The financial stability of the insurance company is a critical factor. A financially strong company is more likely to be able to fulfill its obligations in the event of a major claim. Investigate the company's financial ratings and history to assess its stability. A reputable insurer with a strong financial track record provides greater security and confidence in the long-term protection of your home.

Read more about Tips for Lowering Your Homeowners Insurance Premiums

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![Best Car Insurance Companies in 2025 [Review]](/static/images/30/2025-05/CustomerServiceandClaimsHandling3AACrucialAspect.jpg)

![Tax Planning Tips for Inheritances [2025]](/static/images/30/2025-07/StayingUpdatedonEvolvingTaxLaws.jpg)