Best Budgeting Strategies for People with Variable Income

Establishing a Practical Income Foundation

Assessing Your Present Earnings

Building a reliable financial foundation begins with a detailed examination of your current monetary circumstances. This encompasses not just your primary salary but also supplementary revenue streams like contract work, stock dividends, or secondary occupations. Maintaining thorough records of all earnings channels proves indispensable for gaining complete financial clarity. Precise documentation enables accurate computation of existing income and highlights opportunities for enhancement or diversification.

Scrutinizing financial documents such as bank transaction histories, salary receipts, and portfolio statements yields tangible insights into your active income sources. This granular examination establishes the groundwork for developing practical earnings forecasts.

Calculating Living Costs

Parallel to income evaluation, a systematic classification of expenditures becomes imperative. This process requires organizing all outlays into distinct groups including accommodation, utility services, nourishment, commuting, and leisure activities. Recognizing expenditure patterns forms the cornerstone of effective financial management and future preparation.

Meticulous spending analysis reveals potential opportunities for fiscal optimization and reduction of unnecessary costs. This disciplined approach to expense monitoring represents a fundamental component of sound money management and supports the development of a more balanced financial baseline.

Recognizing Financial Shortfalls

After compiling comprehensive income and expense data, the subsequent phase involves detecting any discrepancies or deficiencies. Do your revenue sources adequately meet your financial obligations? If not, where are the deficiencies most apparent? This analytical process frequently uncovers areas requiring supplemental income solutions or strategic spending reductions.

Investigating Additional Revenue Options

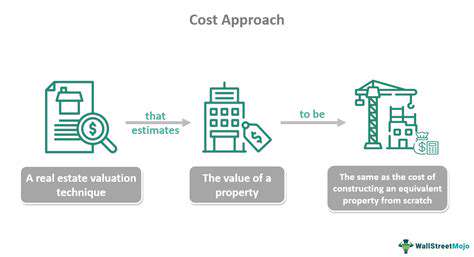

When expenses surpass income, exploring alternative earning possibilities becomes necessary. Potential solutions might include securing supplementary employment, developing consultancy services, or establishing automated income channels like securities portfolios or property leasing. Evaluating diverse income generation methods proves essential for harmonizing earnings with expenditures.

Formulating a Practical Spending Plan

Developing an achievable financial plan remains vital for effective income administration. This budgetary framework should precisely mirror both income and outlays, while accommodating immediate and extended financial objectives. A well-structured financial plan serves as a navigational tool for monetary success.

Honest assessment of spending tendencies and appropriate fund allocation ensures income not only satisfies current needs but also permits future savings and investment opportunities.

Focusing on Monetary Objectives

Defining explicit financial targets, whether establishing a housing fund, eliminating liabilities, or creating emergency reserves, provides necessary motivation for achieving a sustainable income foundation. These aspirations should adhere to SMART criteria (Specific, Measurable, Achievable, Relevant, Time-bound). Articulating precise ambitions offers guidance for financial decision-making.

Ongoing Evaluation and Modification

Financial baselines require continuous refinement rather than remaining fixed. Periodic reassessment and recalibration ensure alignment between income, expenses, and evolving goals. Consistent financial reviews facilitate timely adjustments when needed. This proactive methodology guarantees that income foundations adapt to changing personal circumstances and economic conditions.

Managing Core Expenditures

Identifying Fundamental Costs

Distinguishing and organizing essential expenses remains critical for successful budget creation. Essential expenses represent indispensable requirements for daily living, including shelter, utilities, nourishment, and transportation. Precise determination of these obligations permits appropriate fund allocation, minimizing discretionary spending and financial pressure. Recognizing personal requirements and situations facilitates development of realistic spending plans. Differentiating necessities from desires helps prevent excessive spending on non-critical items.

Detailed examination of essential costs may expose opportunities for modest yet meaningful savings. Implementing energy conservation measures or negotiating service contracts could potentially reduce these expenses. Consistent monitoring and evaluation of spending habits remains crucial for identifying savings potential. Remember, funds preserved on essential costs can be redirected toward other financial priorities like debt management or retirement planning.

Addressing Housing and Utility Priorities

Accommodation expenses, frequently the most substantial essential cost, demand primary consideration. Securing appropriate and affordable housing establishes a foundation for financial security. Evaluate alternatives including leasing versus purchasing, accounting for related expenses like loan repayments, municipal taxes, and insurance premiums. Comprehending housing costs and incorporating them realistically into budgets proves essential. Ensure accommodation expenses don't disproportionately consume income, leaving inadequate resources for other necessities.

Utility services including power, water, and heating constitute additional vital expenses requiring budget consideration. Implementing cost reduction strategies can substantially influence overall financial health. Investigate energy-saving appliances, programmable climate control systems, and routine maintenance to optimize efficiency and minimize expenses. These measures can positively affect budgetary outcomes and promote economic stability.

Optimizing Food and Transportation Budgets

Nourishment and mobility costs often represent significant portions of household budgets. Developing intelligent management strategies for these areas remains vital for financial equilibrium. Meal planning and grocery list preparation can prevent impulsive buying and support budget adherence. Consider increasing home meal preparation to decrease restaurant expenditures. Exploring economical transportation alternatives like mass transit or ride-sharing arrangements may generate additional savings.

Commuting expenses vary considerably based on geographic location and lifestyle. Vehicle owners should incorporate fuel, insurance, servicing, and potential repair costs into financial planning. Public transport users should understand fare structures and ensure reliable mobility options. Strategic planning and adaptation can produce substantial improvements in these critical budget categories.

Modifying Financial Plans for Variable Income

Comprehending Irregular Earnings

Managing unpredictable income streams, such as those experienced by veterans receiving fluctuating VA benefits, requires adaptable budgeting techniques. Recognizing potential income variations, whether resulting from benefit modifications, temporary employment, or other influences, proves crucial for maintaining fiscal stability. This forward-looking perspective enables anticipation of income fluctuations and corresponding spending adjustments, preventing financial hardship during reduced income periods and capitalizing on higher earning phases.

Developing an Adjustable Budget Framework

Fixed budgets designed for consistent earnings prove ineffective with variable income. Instead, construct a flexible budget template permitting modifications. This framework should incorporate categories for fixed expenses (housing, utilities, groceries) and discretionary spending (recreation, dining). Distribute funds according to *projected* rather than actual income. Incorporating contingency provisions for unexpected costs remains critical.

Consider employing digital budgeting tools or spreadsheet applications to monitor income and expenditures. These resources provide immediate visibility into cash flow patterns and facilitate necessary adjustments.

Emphasizing Vital Expenses

During income instability, prioritizing essential costs becomes paramount. Shelter, utilities, and basic groceries should receive first consideration. These represent non-discretionary obligations requiring fulfillment before allocating resources to less critical areas like entertainment or restaurant meals.

Leveraging Emergency Reserves

Creating and preserving emergency savings proves essential. These funds serve as financial protection during low-income periods or unforeseen expenses. Target maintaining three to six months' living expenses in this reserve, providing stability during unexpected circumstances. This proves particularly important for veterans whose income may depend on VA benefits subject to processing delays or modifications.

Adapting Expenditure Patterns

Acknowledge that spending behaviors must correspond to income levels. During reduced income intervals, limit non-essential purchases. This might involve decreasing restaurant visits, terminating unnecessary subscriptions, or postponing acquisitions. Conversely, during elevated income periods, consider increasing savings contributions, accelerating debt repayment, or allocating additional funds to investment vehicles.

Consulting Financial Professionals

When managing irregular income proves challenging, professional financial consultation may prove beneficial. Certified financial planners can develop customized budgets reflecting specific income patterns and objectives. They offer valuable perspectives on optimizing VA benefits and formulating long-term financial strategies, particularly important for veterans navigating complex economic situations.

Read more about Best Budgeting Strategies for People with Variable Income

Hot Recommendations

- Best Investment Strategies for Income Generation

- Budgeting for Pets (Unexpected Costs)

- Growth Investing Explained: Is It Right for You?

- Best Budgeting Strategies for People with Variable Income

- How to Use Momentum Investing

- Tips for Managing Credit Card Rewards While in Debt

- Best Investment Strategies for Short Term Goals

- How to Budget for Unexpected Expenses

- Best Investment Strategies for Young Investors

- How to Budget for Hobbies

![How to Stop Impulse Buying and Save Money [Budgeting Tips]](/static/images/30/2025-06/BuildinganEmergencyFund3APreventingFinancialCrisesandReducingStress.jpg)