Guide to Understanding Insurance Riders

What Are Insurance Riders?

Understanding the Basics of Insurance Riders

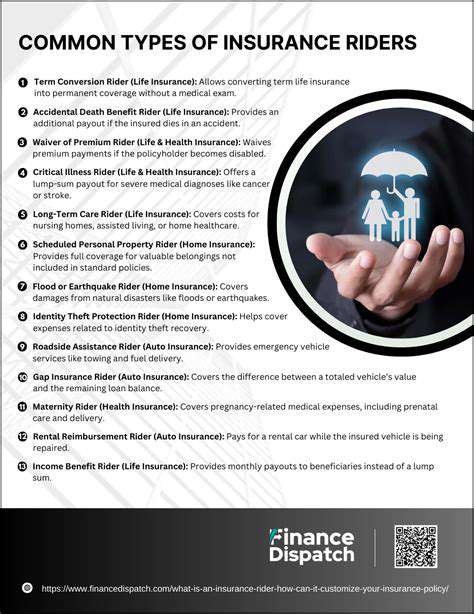

Insurance riders act as customizable enhancements to standard policies, letting policyholders tailor coverage to unique situations. These add-ons function like specialized tools, expanding protection beyond basic policy limits. For instance, while a typical homeowner's policy excludes flood damage, adding a flood rider bridges this gap effectively.

Riders address specific vulnerabilities that standard policies overlook. A cancer diagnosis rider, for example, provides lump-sum payouts upon diagnosis, offering financial relief when it's needed most. This granular approach to coverage ensures protection aligns precisely with individual risk profiles.

Types of Common Insurance Riders

The insurance market offers diverse riders catering to distinct needs. Critical illness coverage stands out, providing immediate funds upon diagnosis of specified conditions. Disability income riders offer monthly payments if injuries prevent work, while accidental death benefits supplement standard life insurance payouts.

In auto insurance, roadside assistance riders prove invaluable during breakdowns. Waiver of premium riders, particularly in life insurance, maintain coverage during disability without requiring payments. Each rider carries unique provisions that demand careful examination before selection.

How Riders Affect Premiums

Premium adjustments reflect the expanded coverage riders provide. A long-term care rider on life insurance might increase costs by 15-25%, while a simple accidental death rider may add just 2-5%. The key lies in balancing enhanced protection against budget constraints.

Insurers calculate rider costs based on risk exposure and administrative expenses. Some riders, like return-of-premium options, cost more initially but offer refunds if unused. This complex pricing structure requires policyholders to evaluate both immediate and long-term financial impacts.

Important Considerations When Choosing Riders

Selecting appropriate riders involves careful self-assessment. Young parents might prioritize child term riders, while empty nesters may focus on chronic illness coverage. Life stage and financial obligations should drive rider selection more than sales pitches.

Policyholders should review riders annually as circumstances change. What made sense five years ago might no longer apply. Regular reviews with a trusted advisor ensure coverage evolves with life's transitions.

Evaluating the Costs and Benefits of Riders

Initial Investment Costs

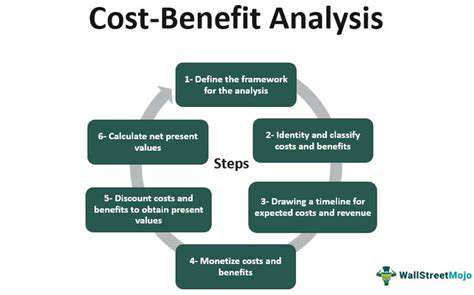

Adding riders requires evaluating both direct and indirect costs. The true expense includes not just premium increases but also opportunity costs of alternative uses for those funds. Some riders like guaranteed insurability options prove invaluable later despite current costs.

Compound effects matter - a $20/month rider costs $7,200 over 30 years. Would investing that money elsewhere provide better protection? This long-view analysis separates wise choices from wasteful spending.

Operational Expenses

Ongoing rider costs can fluctuate with age and health status. Some riders automatically adjust premiums at certain ages, potentially creating budget surprises. Understanding these escalation clauses prevents future financial strain.

Administrative fees sometimes hide in fine print. Policyholders should inquire about any charges for rider modifications or cancellations to avoid unexpected expenses.

Potential Benefits Streams

Riders create multiple benefit pathways. A disability waiver rider saves premium payments during incapacity, while a return-of-premium rider functions like a forced savings plan. The most valuable riders often address low-probability but high-impact events.

Some riders offer living benefits, allowing access to death benefits for terminal illnesses. This liquidity option can prove crucial during medical crises.

Time to Value and Return on Investment (ROI)

Rider ROI varies dramatically by type. Short-term riders like rental car coverage offer immediate benefits, while long-term care riders may take decades to pay off. The break-even point depends on individual health trajectories and life circumstances.

Statistical probabilities matter - the average person has a 20% chance of disability before retirement, making disability riders potentially more valuable than many realize.

Risk Assessment and Mitigation Strategies

Riders represent risk transfer mechanisms. Choosing appropriate riders involves honest assessment of personal risk tolerance and financial resilience. Those with substantial savings might forego certain riders that others find essential.

Layering riders creates customized safety nets. Combining critical illness with disability coverage addresses both medical costs and income replacement needs.

Sustainability and Adaptability

Effective rider strategies evolve with life changes. What protects a young family differs markedly from what safeguards empty nesters. Regular policy reviews ensure coverage remains aligned with current needs rather than past circumstances.

Some riders become redundant over time - mortgage protection riders lose relevance after home loans are paid. Pruning unnecessary riders keeps costs manageable.

Reviewing and Modifying Your Rider Choices

Understanding Your Current Coverage

Begin reviews by cataloging existing riders and their purposes. Many policyholders discover redundant or obsolete coverage during this process. Create a simple spreadsheet tracking each rider's cost, benefits, and expiration terms.

Compare current riders against life stage needs. New parents might need to add child coverage, while recent retirees may reduce certain protections.

Identifying Necessary Adjustments

Look for coverage gaps first - common oversights include insufficient disability or long-term care provisions. Then identify over-insured areas where premium dollars could be better allocated.

Health changes often warrant rider modifications. Improved health might qualify for better rates on certain riders, while new diagnoses might necessitate additional coverage.

Setting Modification Goals

Establish clear objectives like Reduce rider costs by 15% without sacrificing essential coverage or Add critical illness protection. Quantifiable targets focus the review process and measure success.

Prioritize changes addressing immediate risks first. A freelancer might prioritize disability coverage over other riders due to income volatility.

Developing an Implementation Plan

Schedule rider changes to coincide with policy anniversaries when possible to avoid prorated charges. Coordinate multiple policy reviews to leverage cross-policy insights.

Create a timeline for implementing changes, allowing time for underwriting approvals where required. Some riders require medical exams or financial verification.

Executing Changes and Validating Results

Document all modification requests and insurer confirmations. Follow up to ensure changes appear correctly on updated policy documents. Mistakes in rider administration are surprisingly common.

After implementation, verify premium adjustments match expectations. Discrepancies often reveal processing errors needing correction.

Establishing Ongoing Review Processes

Set calendar reminders for annual reviews at minimum. Major life events (marriage, birth, retirement) should trigger immediate reviews. Treat insurance coverage as a dynamic component of financial planning.

Maintain a rider decision journal noting why specific choices were made. This creates valuable context for future reviews and prevents cyclical second-guessing.

Read more about Guide to Understanding Insurance Riders

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![Best Tools for Debt Management [2025]](/static/images/30/2025-05/DebtManagementPlans28DMPs293APersonalizedStrategiesforRepayment.jpg)

![Best Travel Insurance Policies [2025 Review]](/static/images/30/2025-05/CrucialConsiderations3ATripTypeandDestinationImpact.jpg)