Budgeting for One: Tips for Living Alone Affordably

Understanding Your Income

To effectively track your spending, you first need a clear understanding of your income. This involves more than just your salary; it encompasses all sources of money coming into your account, such as side hustles, freelance work, investments, or any other form of regular or occasional income. Detailed records of each income source, including the date received and the amount, are crucial for budgeting accurately and ensuring you're not overspending.

Categorizing your income streams can help you visualize where your money is coming from and how much you have available for expenses and savings each month. This allows for a more realistic assessment of your financial situation and helps prevent overestimating your resources.

Identifying Your Expenses

The next crucial step in tracking your spending is identifying all your expenses. This includes everything from rent or mortgage payments, utilities, groceries, transportation, and entertainment, to smaller, more frequent expenses like coffee, snacks, or subscriptions. Be meticulous in listing every outflow of money, no matter how small it seems.

Creating a comprehensive list of expenses helps you understand where your money is going and pinpoint areas where you might be overspending. This awareness is the first step toward making informed financial decisions.

Categorizing Your Spending

Once you've identified all your expenses, categorize them logically. This could include categories like housing, food, transportation, entertainment, debt payments, and savings. Categorizing your spending is important because it provides a clear picture of where your money is going. You'll be able to see which categories are consuming the most of your budget.

Regularly reviewing your spending categories can help you identify patterns and areas for potential savings. For example, if you notice you're spending a disproportionate amount on dining out, you can explore alternative options to reduce costs and reallocate funds to other areas.

Using Budgeting Apps and Tools

Numerous budgeting apps and tools are available to simplify the process of tracking your spending. These apps often provide features for categorizing expenses, setting budgets, and visualizing your spending habits. Many offer personalized insights and recommendations for improvement, making it easier to manage your finances.

Using such tools allows for a more organized and efficient way to monitor your budget. They also facilitate data analysis, making it possible to identify trends and areas of potential overspending quickly, leading to more informed financial decisions.

Setting Realistic Budgets

After gaining a clear understanding of your income and expenses, you can begin setting realistic budgets. This involves allocating a portion of your income to different categories, ensuring that your spending aligns with your financial goals. A realistic budget considers both your needs and wants, ensuring that you are not overextending yourself financially.

Setting a budget that is too restrictive can lead to frustration and ultimately hinder the process. Conversely, a budget that is too lenient can lead to overspending and impede your financial progress. Finding a balance between your desires and your financial capacity is key to success.

Tracking Your Progress and Adjusting Your Budget

Regularly monitoring your progress against your budget is essential for maintaining financial stability. This involves tracking your spending on a weekly or monthly basis and comparing it to your allocated budget. If you notice you're consistently exceeding your budget in certain categories, you can adjust your spending habits or reallocate funds to reduce the outflow.

Automating Savings and Debt Repayment

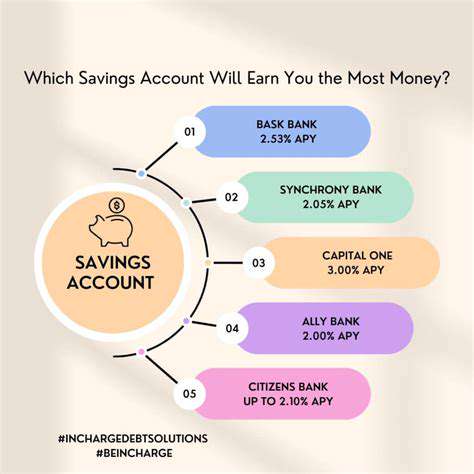

To further streamline your financial management, automate your savings and debt repayment. This can involve setting up automatic transfers to savings accounts or using tools to schedule payments toward your debts. Automation ensures that a portion of your income is consistently directed towards your financial goals, even when you're busy or distracted.

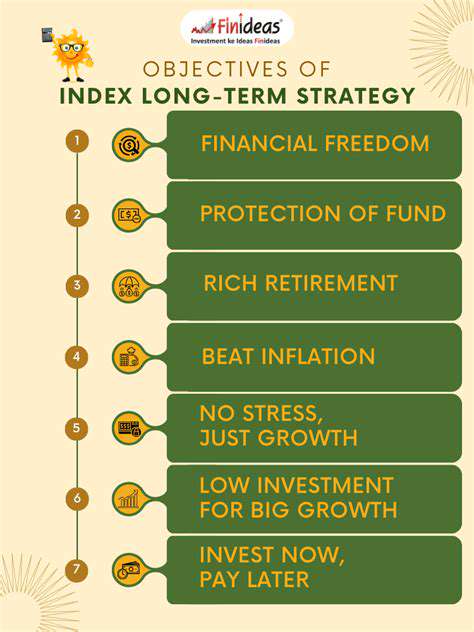

Automating these tasks can significantly reduce the likelihood of neglecting these crucial aspects of your financial well-being. This consistent effort will gradually move you towards greater financial freedom.

Read more about Budgeting for One: Tips for Living Alone Affordably

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![How to Buy and Sell Cryptocurrency [Beginner Guide]](/static/images/30/2025-06/SellingYourCryptocurrencyandManagingRisk.jpg)

![Tax Optimization Tips for Investors [2025]](/static/images/30/2025-07/CapitalGainsStrategiesforMinimizingTaxBurdens.jpg)