How to Use Day Trading Strategy (High Risk)

Understanding the Basics of Day Trading

Day trading, a demanding yet rewarding investment approach, revolves around executing buy and sell orders within a single market session. This high-speed strategy demands more than just luck—it requires mastering market rhythms, chart patterns, and risk control. Seasoned traders know success isn't about crystal balls, but spotting fleeting opportunities through careful observation of price action.

Top performers combine razor-sharp analysis with lightning-fast execution, backed by comprehensive platform knowledge. Forget get-rich-quick fantasies—consistent profits emerge from military-grade discipline, meticulous preparation, and ironclad trading rules.

Choosing Your Trading Weapons

Instrument selection separates winners from losers. Liquidity, volatility, and short-term movement potential dictate your choices. Equities, currency pairs, derivatives, and options each offer distinct advantages—and hidden pitfalls.

Mastering your chosen market's unique personality through historical pattern analysis and sentiment tracking forms the foundation of profitable trading. Never underestimate the double-edged sword of leverage—it can amplify both gains and losses.

Building an Unshakable Trading Framework

Your trading blueprint should clearly mark attack points, retreat lines, and profit objectives. This battle plan transforms emotional reactions into calculated maneuvers during market storms.

Automatic stop-loss mechanisms act as your financial bodyguard, ejecting you from trades before small losses become account killers. These digital sentries protect your war chest through countless trading sessions.

Decoding Market Signals

Chart reading forms the trader's sixth sense. Candlestick formations, technical indicators, and volume patterns whisper the market's next move to those who understand their language.

True mastery comes from recognizing how indicators dance with price action, spotting hidden patterns, and developing spider-sense for subtle shifts. This art demands endless practice and study.

The Risk Control Mindset

Capital preservation separates professionals from gamblers. Knowing your pain threshold and sizing positions accordingly builds longevity in this high-stakes arena. Accept that losses are tuition payments in the school of trading.

Reading the Market's Mood

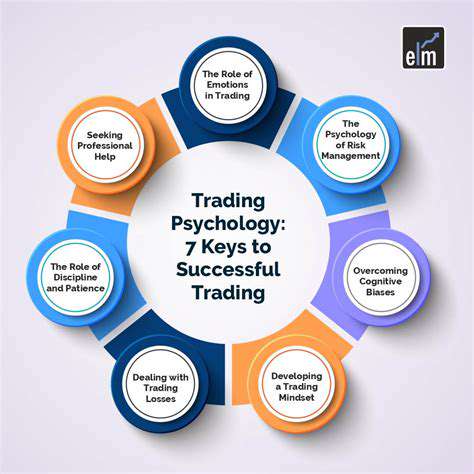

Markets breathe with collective emotion. Recognizing how fear and greed move prices helps maintain rational decision-making. Your greatest adversary sits between your ears—master your psychology before attempting to master markets.

Develop radar for market sentiment while remembering crowds often overreact. Economic reports and breaking news move markets, but rarely as predictably as textbooks suggest.

Adapting to Market Evolution

Financial markets mutate constantly. Survival demands continuous education about emerging trends, regulatory shifts, and technological disruptions. Your strategies must evolve faster than the markets you trade.

Ruthless performance reviews spotlight weaknesses. The most dangerous trader is one who won't adapt. Build feedback loops into your routine to ensure continuous improvement.

Developing a Robust Day Trading Plan: Key Considerations

Finding Your Trading DNA

Your trading personality dictates strategy. Are you a scalper capturing microscopic moves or a momentum rider surfing larger waves? Your comfort with risk and market noise determines which styles fit like gloves. Sector specialization can sharpen your edge.

Historical performance data reveals what works—and what destroys accounts. Different approaches demand unique toolkits—choose indicators that align with your trading rhythm.

Precision Entry and Exit Tactics

Clear attack points emerge from confluence zones—where multiple technical signals agree. Your entry trigger should be so precise it feels like cheating. Moving averages, Fibonacci levels, and volume spikes often mark these decision points.

Exit strategies require equal clarity. Pre-set profit targets and stop-losses act as autopilot when emotions threaten judgment. Knowing when to retreat preserves capital for tomorrow's battles.

The Mathematics of Survival

Risk management separates temporary winners from permanent professionals. Never stake more than 1-2% of capital on any single trade—this simple rule keeps you in the game.

Stop-loss orders function as financial circuit breakers. These automated guardians enforce discipline when human judgment falters. Combine with position sizing to control risk exposure.

Stress-Testing Your Strategy

Historical simulation reveals strategy flaws before real money's at stake. Backtesting uncovers hidden weaknesses like a medical scan reveals health risks.

Markets evolve—so must your approach. Regular strategy tune-ups maintain competitive edge as market conditions shift. Stay flexible enough to adopt new tools when proven effective.

The Feedback Loop

Treat your trading journal like a flight recorder—it reveals what went wrong after crashes. Patterns emerge from careful trade analysis that would otherwise remain invisible.

Economic calendars and news feeds act as early warning systems. The best traders anticipate change before charts reflect it. Build information networks that keep you ahead of the herd.

Risk Management Techniques for Day Traders: Protecting Capital

Mapping the Minefield

Comprehensive risk analysis separates survivors from casualties in trading's battlefield. Recognizing danger zones—from market shocks to psychological traps—forms your first line of defense. Study historical crises to anticipate future threats.

Every asset class carries unique hazards. Understanding these peculiarities helps navigate turbulent markets without panic. Technical failures and liquidity droughts can ambush the unprepared.

The Diversification Advantage

Spreading capital across uncorrelated assets acts as portfolio armor. When one position bleeds, others may compensate—this natural hedge smooths performance. Avoid overconcentration in single sectors or instruments.

Effective diversification requires understanding how assets interact. True diversification means owning assets that don't move in lockstep during storms.

Automated Defense Systems

Stop-loss orders function like ejection seats for losing trades. Proper placement considers normal price fluctuations while preventing catastrophic damage. Volatility measurements inform optimal stop positioning.

Position sizing determines battle engagement levels. Smaller positions equal longer survival during drawdown periods. The 1% rule prevents single trades from crippling your account.

Market Surveillance

Real-time monitoring acts as your trading radar. Economic releases, earnings surprises, and geopolitical events can trigger market quakes—early detection saves fortunes.

Technical indicators flash warning signs before major moves. Volume spikes and volatility expansion often precede trend changes. Develop sensitivity to these subtle shifts.

The Psychology of Defense

Emotional control forms your mental armor. Trading plans transform subjective decisions into systematic processes. When markets rage, your plan becomes the lifeline keeping you anchored.

Review sessions reinforce successful behaviors. Pattern recognition helps replicate winning trades while eliminating recurring mistakes. Treat each session as a learning opportunity.

Read more about How to Use Day Trading Strategy (High Risk)

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt