Understanding the Basics of Forex Trading

Risk Management and Protecting Your Capital

Identifying Potential Risks

Effective risk management begins with a thorough understanding of the potential threats and vulnerabilities that could impact your financial well-being. This includes analyzing economic fluctuations, market trends, and geopolitical events. Identifying these risks is crucial because it allows you to develop proactive strategies to mitigate their impact. Understanding potential risks empowers you to make informed decisions and protect your financial future.

A key aspect of identifying potential risks is to consider the various aspects of your life that could influence your financial stability. These factors might include job security, changes in personal circumstances, or unforeseen medical expenses. By proactively identifying these potential risks, you can take steps to prepare for them and minimize the negative consequences.

Developing a Risk Mitigation Strategy

Once you have identified potential risks, the next step is to develop a comprehensive risk mitigation strategy. This plan should outline specific actions and steps to take to address each identified risk. A robust strategy should include diversification of investments, contingency planning for unexpected expenses, and exploring insurance options to protect against various potential losses. Implementing a well-defined strategy is essential for safeguarding your financial assets and achieving your financial goals.

Consider the various levels of risk that you are willing to accept. A risk mitigation strategy should align with your personal risk tolerance. It is important to understand that different levels of risk may apply to different aspects of your finances. For instance, you might be comfortable with a higher level of risk in your investment portfolio but might prefer a lower level of risk for your emergency fund.

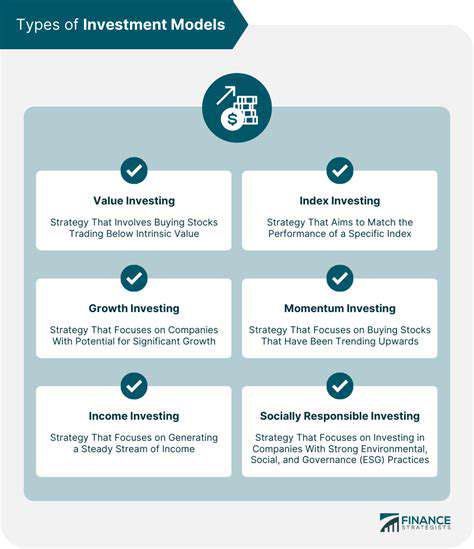

Diversifying Investments

Diversifying your investments is a crucial aspect of risk management. This involves spreading your investments across different asset classes, such as stocks, bonds, and real estate. This strategy helps to reduce the impact of any single investment's performance on your overall portfolio. By diversifying your investments, you are reducing your vulnerability to market fluctuations and ensuring a more stable financial future.

Diversification is important because it helps to balance potential gains and losses across your investments. This approach can help you weather market downturns and potentially achieve better long-term returns.

Creating a Contingency Fund

A contingency fund is a crucial component of any effective risk management plan. This fund is designed to provide financial resources for unexpected events and emergencies. It acts as a safety net, ensuring that you have the financial means to handle unforeseen circumstances without jeopardizing your other financial goals. This fund is essential for maintaining financial stability during challenging times.

Insurance as a Risk Management Tool

Insurance plays a vital role in mitigating various financial risks. It provides a safety net against unexpected events such as accidents, illnesses, or property damage. Insurance policies can provide coverage for a wide range of risks, helping you to protect your assets and financial well-being. Understanding the different types of insurance available and selecting appropriate coverage is essential in protecting your assets.

By carefully considering the various types of insurance, you can tailor your coverage to fit your specific needs and circumstances. This proactive approach to risk management allows you to protect yourself and your family from potential financial losses.

Regular Monitoring and Adjustment

Risk management is not a one-time activity. It requires continuous monitoring and adjustment to reflect changing circumstances and market conditions. Regularly reviewing your risk mitigation strategy and contingency plans is essential to ensure they remain effective. As your life and financial situation evolve, your risk tolerance and strategies should adapt accordingly.

Staying informed about market trends and potential risks is essential for maintaining a robust risk management approach. By continuously evaluating and adapting your strategy, you can maintain a proactive approach to safeguard your financial future and achieve your financial goals.

Read more about Understanding the Basics of Forex Trading

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![Best Travel Insurance Policies [2025 Review]](/static/images/30/2025-05/CrucialConsiderations3ATripTypeandDestinationImpact.jpg)