How to Invest in Peer to Peer (P2P) Lending

Key Advantages of P2P Lending Investments

Diversification Benefits

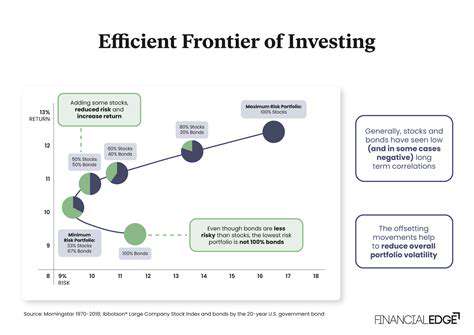

One standout feature of P2P lending is its ability to diversify your investment portfolio. Unlike traditional stock or bond investments, P2P lending enables you to distribute funds across multiple borrowers, reducing reliance on any single investment. This strategy helps cushion your portfolio against the impact of underperforming loans, creating a more stable financial foundation. By selecting borrowers with varying credit backgrounds and loan terms, you can achieve a balanced return that's less susceptible to market volatility.

Additionally, P2P platforms provide access to loan types not typically available through conventional banks. Some platforms offer asset-backed loans, such as those secured by real estate, while others focus on small business financing. This variety allows investors to customize their portfolios based on personal risk tolerance, gaining exposure to different economic sectors and potentially enhancing overall returns.

Potential for Enhanced Returns

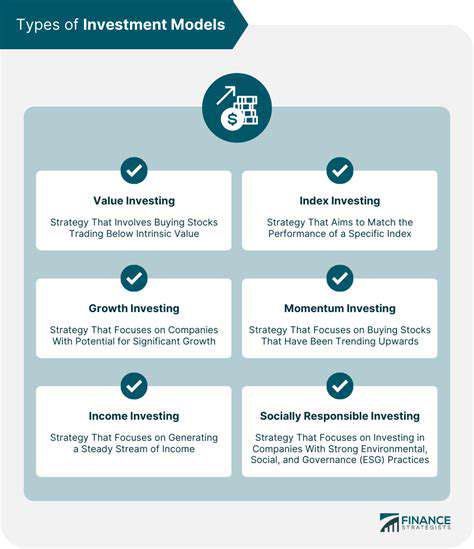

P2P lending frequently delivers higher interest rates than traditional savings accounts or CDs. These elevated rates compensate lenders for the additional risk involved in direct lending. While not guaranteed, this feature makes P2P lending attractive for investors seeking above-average returns. However, it's vital to remember that greater potential rewards always come with increased risk exposure.

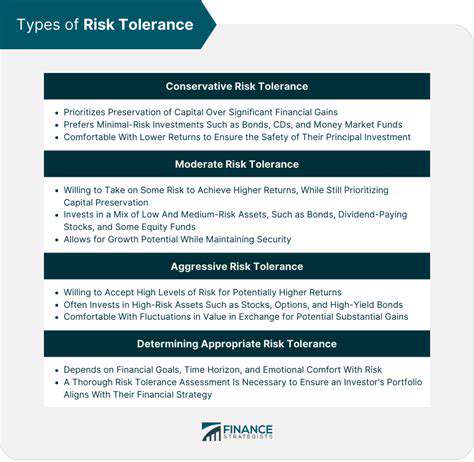

The competitive P2P lending landscape, with its multitude of platforms and loan products, often creates favorable conditions for investors. This competition can drive interest rates upward, benefiting discerning investors who carefully evaluate opportunities. Successful investing requires thorough platform research and loan analysis to ensure alignment with your financial objectives and risk tolerance.

While the prospect of higher returns is appealing, it's not automatic. Investors must conduct comprehensive due diligence, examining borrower creditworthiness, loan terms, and platform security measures before committing funds.

Assessing Risk and Managing Your Portfolio

Fundamentals of Risk Evaluation

Effective risk assessment forms the cornerstone of sound investment management. This process involves identifying potential threats that could jeopardize your financial goals. A thorough risk evaluation examines all possible vulnerabilities, from market fluctuations to operational challenges, enabling you to develop appropriate safeguards.

Financial risks might involve changing interest rates or economic downturns, while operational risks could include platform failures or processing delays. Recognizing these distinct risk categories allows for targeted mitigation strategies tailored to each potential challenge.

Creating a Comprehensive Risk Management Strategy

A well-designed risk management plan serves as your financial safety net. It should clearly define team roles, reporting procedures, and escalation protocols. Regular plan updates ensure continued relevance as market conditions evolve.

Effective plans incorporate multiple protective measures, including contingency options for unexpected events and clear communication channels. Identifying specific risk triggers enables prompt response, helping maintain portfolio stability during turbulent periods.

Implementing and Refining Risk Controls

Putting your risk management strategies into action requires ongoing attention. Regular performance reviews and adjustments ensure your safeguards remain effective. Continuous team communication keeps all stakeholders informed about emerging risks and implemented countermeasures.

Risk management isn't static - it demands constant vigilance. Flexibility is crucial when confronting unforeseen challenges, requiring periodic reassessment of your strategies to address new market realities.

Strategies for Maximizing Returns and Minimizing Losses

Portfolio Diversification Techniques

Diversification remains the bedrock of P2P investment success. By spreading investments across multiple platforms and borrower types, you reduce dependence on any single source. This approach helps balance your risk exposure, as stronger-performing loans can offset any underperformers.

Careful platform selection is equally important. Evaluating each platform's lending criteria, borrower vetting processes, and historical performance helps create a well-rounded investment portfolio. Diversification across platforms with different risk profiles enhances overall stability while maintaining return potential.

Aligning Investments with Personal Risk Tolerance

Before committing funds, honestly assess your comfort with risk. P2P lending offers various risk-reward profiles - from conservative options with predictable returns to higher-risk loans with greater potential rewards. Matching your investments to your personal risk tolerance prevents emotional decision-making during market fluctuations.

Clearly defining your financial objectives - whether short-term gains or long-term growth - helps guide investment choices. Understanding how potential losses might affect your overall financial health ensures your P2P lending activities complement your broader financial strategy.

Conducting Thorough Platform Research

Extensive due diligence separates successful investors from the rest. Investigate platform histories, security protocols, and regulatory compliance. Transparent platforms with robust borrower verification processes typically offer more reliable investment opportunities.

Examine platform dispute resolution procedures and loan recovery processes. Understanding these operational details provides insight into how platforms handle challenges, helping you make more informed investment decisions.

Active Portfolio Management

Regular portfolio reviews are essential for maintaining optimal performance. Monitor loan performance indicators and be prepared to rebalance your investments as needed. Proactive adjustments help capitalize on emerging opportunities while minimizing exposure to underperforming assets.

Stay informed about market trends and platform developments. This ongoing education enables timely strategy adjustments, keeping your investment approach aligned with current market conditions.

Leveraging Professional Expertise

Consider consulting financial professionals specializing in P2P investments. Their expertise can provide valuable market insights and help refine your investment strategy. Professional guidance becomes particularly valuable when navigating complex investment decisions or market uncertainties.

Stay current with industry publications and regulatory updates. Combining professional advice with personal research creates a comprehensive approach to P2P lending that maximizes potential returns while managing risk effectively.

Read more about How to Invest in Peer to Peer (P2P) Lending

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![Best Tools for Debt Management [2025]](/static/images/30/2025-05/DebtManagementPlans28DMPs293APersonalizedStrategiesforRepayment.jpg)

![Best Health Insurance Plans for Families [2025]](/static/images/30/2025-05/EvaluatingCoverageandBenefits.jpg)