How to Choose Your Retirement Age

Factors to Consider When Deciding Your Retirement Date

Financial Security and Goals

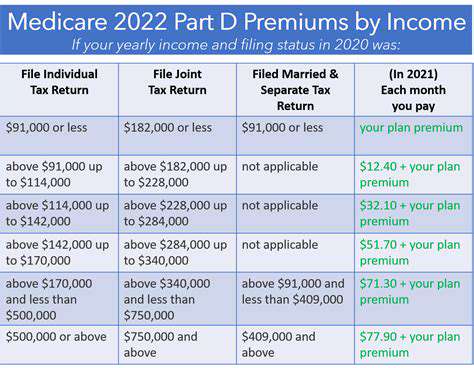

One of the most critical aspects of choosing when to retire revolves around evaluating your financial readiness. This means taking a hard look at your current nest egg, investment portfolio, and expected income sources during retirement. Don't overlook existing debts like home loans, personal loans, or credit card balances that could weigh you down. Creating realistic estimates of future living costs - accounting for inflation and potential medical expenses - forms the bedrock of any solid retirement strategy.

Equally vital is aligning your retirement timeline with your personal dreams. Maybe you've always wanted to take that around-the-world trip or finally have time to master oil painting. These personal ambitions directly affect how much you'll need to save and when you can comfortably leave the workforce.

Health and Physical Well-being

Your body's condition today and its likely trajectory should heavily influence your retirement decision. Be honest about any chronic conditions that might require more medical attention (and expenses) down the road. Consider whether you have the stamina now for activities you hope to pursue in retirement, and how that might change in five or ten years. Making this assessment now helps ensure you retire when you can still fully enjoy your newfound freedom.

Lifestyle Preferences and Aspirations

Picture your ideal Tuesday in retirement. Are you hiking mountain trails or enjoying leisurely coffee with friends? Maybe you're volunteering at the local animal shelter or finally writing that novel. The activities you most look forward to should dictate your retirement timing more than arbitrary age milestones. Someone craving adventure might need to work longer to fund those experiences, while those content with simpler pleasures could retire sooner.

Career and Employment Status

Take stock of your current job satisfaction and prospects. Some companies offer enticing early retirement packages that could accelerate your plans. Others might provide flexible transition options like phased retirement. If you're still climbing the corporate ladder or deeply engaged in meaningful work, pushing your retirement date back might make perfect sense.

Family and Social Obligations

Retirement decisions rarely happen in a vacuum. Maybe you're helping care for grandchildren or have elderly parents who might need more assistance soon. Perhaps you've promised to help with a community project that requires your expertise. These commitments often create invisible timelines that should factor into your retirement calculus.

Market Conditions and Economic Outlook

While you can't predict stock market movements, retiring during a downturn can significantly impact your nest egg's longevity. Financial advisors often recommend having two years' worth of living expenses in cash to weather market volatility. Pay attention to broader economic indicators like inflation rates and interest trends when fine-tuning your retirement date.

Personal Values and Priorities

At its core, retirement timing is a deeply personal equation. What matters more to you - financial security or time freedom? Professional accomplishments or family connections? The most satisfying retirements happen when the timing aligns with what you truly value, not societal expectations. Spend time reflecting on what enough looks like in all areas of your life before setting your retirement date in stone.

Read more about How to Choose Your Retirement Age

Hot Recommendations

- How to Budget for Home Renovations

- Understanding Estate Taxes

- How to Dispute Errors on Your Credit Report

- How to Pay Off Credit Card Debt with Zero Interest Offers

- Understanding Algorithmic Trading (Basics)

- How to Save Money on Entertainment

- Understanding the Efficient Frontier in Portfolio Building

- Tips for Improving Your Credit Utilization Ratio

- Guide to Investing in Global Markets

- Saving Money Tips for Paying Off Debt Faster

![How to Buy and Sell Cryptocurrency [Beginner Guide]](/static/images/30/2025-06/SellingYourCryptocurrencyandManagingRisk.jpg)