Best Ways to Track Your Net Worth

Staying Consistent and Adapting Your Approach

Understanding Your Baseline

Establishing a solid understanding of your current net worth is crucial for tracking progress. This involves meticulously compiling all your assets, including checking accounts, savings accounts, investments, real estate holdings, and any other valuable possessions. Accurate documentation is paramount, as it forms the foundation for future comparisons and allows you to see how your financial situation changes over time. This initial baseline provides a clear picture of your starting point, enabling you to identify areas for improvement and measure the effectiveness of your strategies.

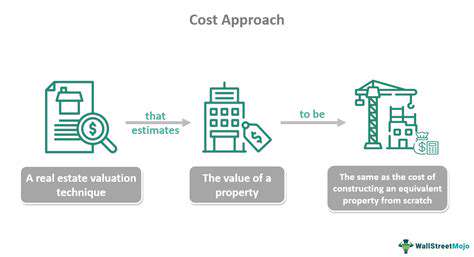

Categorizing Your Assets and Liabilities

To gain a comprehensive view of your financial health, categorizing your assets and liabilities is essential. Assets represent items of value, such as cash, investments, and property. Liabilities, on the other hand, are debts or obligations. A clear categorization allows for a more focused analysis of your financial standing, enabling you to understand the proportion of assets to liabilities and identify potential areas of concern or opportunity for improvement.

This categorization process also helps you to understand the different types of assets and liabilities you have. For example, you might have high-yield savings accounts, stocks, bonds, and a mortgage. Separating these categories allows you to better assess the potential risks and returns associated with each.

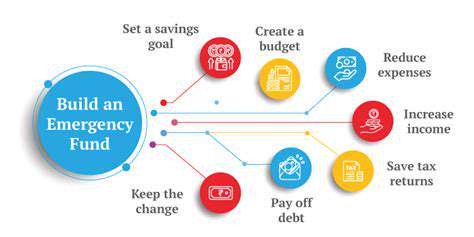

Regular Tracking of Income and Expenses

Consistent tracking of your income and expenses is vital for maintaining an accurate net worth calculation. This involves meticulously recording all sources of income, be it salary, investments, or other sources. Similarly, every expense, from rent to groceries to entertainment, should be documented. This detailed record allows you to identify areas where you might be overspending and enables you to make informed financial decisions.

Utilizing Budgeting Tools and Software

Leveraging budgeting tools and software can significantly streamline the tracking process. These tools often provide visual representations of your income and expenses, highlighting potential areas for improvement. Many offer features to categorize transactions, automate recurring payments, and provide insightful reports that can aid in understanding your spending habits and financial trends.

Employing a Spreadsheet or Financial Management App

For a more hands-on approach, a spreadsheet or dedicated financial management application can be extremely helpful. These platforms allow for detailed input of income, expenses, assets, and liabilities, enabling you to create custom reports and charts. The flexibility of these tools empowers you to tailor your tracking system to your specific financial needs and preferences.

Reviewing and Adjusting Your Strategy

Regularly reviewing your tracking strategy is essential for optimal financial health. As your financial situation evolves, your approach may need adjustments. Consider factors like market changes, career advancements, or life events that might impact your income and expenses. Staying adaptable in your approach allows you to effectively monitor your progress and modify your strategies as needed to maintain a clear picture of your financial journey.

The Importance of Consistency

Consistency in tracking your net worth is paramount. Regular updates, even if they are brief, provide a more comprehensive picture of your financial standing than infrequent, extensive reviews. This consistent effort allows you to identify trends and potential issues early on, enabling you to make necessary adjustments and ultimately achieve your financial goals. Regularity is key to effective and successful net worth tracking.

Read more about Best Ways to Track Your Net Worth

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![Best Budgeting Apps for 2025 [Top Picks]](/static/images/30/2025-05/AdvancedBudgetingAppswithInvestmentTools.jpg)

![Best Investment Strategies for High Inflation Environments [2025]](/static/images/30/2025-05/BeyondtheBasics3AExploringAlternativeInvestments.jpg)