Best Budgeting Books to Read in 2025

Understanding Your Income and Expenses

When starting your budgeting journey, the most critical task is gaining clarity about your financial inflows and outflows. Many people overlook this fundamental step, but without accurate knowledge of where your money comes from and where it disappears to, any budget will be built on shaky ground. Begin by documenting every source of income - not just your primary paycheck, but also any side gigs, investment dividends, or occasional windfalls. This comprehensive approach gives you the full picture of your earning potential.

Equally important is tracking expenditures with meticulous detail. That morning coffee, the impulse online purchase, the forgotten subscription service - they all add up. Financial experts agree that most people underestimate their spending by 20-30% when they don't track carefully. Create categories that make sense for your lifestyle, whether that's separating dining out from groceries or having a specific pet expenses column. The more granular your tracking, the more powerful insights you'll gain.

One area where many budgets fail is accounting for irregular but predictable expenses. These aren't true emergencies, but expenses that occur periodically - think annual insurance premiums, holiday gifts, or car maintenance. Financial planner Jane Doe recommends, Set aside money monthly for these expenses so you're not caught off guard when they arise. This proactive approach prevents budget blowouts and reduces financial stress.

Creating a Realistic Budget

With your financial data in hand, it's time to craft a spending plan that works for your real life, not some idealized version. The most effective budgets aren't about deprivation, but about alignment - ensuring your money supports your values and goals. A budget that feels like punishment will never last, but one that helps you achieve what matters most can become a lifelong tool.

Popular frameworks like the 50/30/20 rule provide helpful starting points, but personal finance isn't one-size-fits-all. For someone in a high-cost urban area, housing might demand 40% of their income, while another person might spend more on healthcare. The key is understanding your unique circumstances. As financial coach Mark Smith notes, Your budget should fit your life like a tailored suit, not like an off-the-rack garment that never quite feels right.

Tracking and Adjusting Your Budget

The most beautifully crafted budget means nothing if you don't use it consistently. Think of your budget as a living document that evolves with you. Regular check-ins - whether weekly, biweekly, or monthly - transform budgeting from a chore into a powerful financial tool. These sessions allow you to celebrate wins (I stayed under my dining out budget!) and course-correct when needed (I need to adjust my entertainment allocation).

Technology can be a powerful ally here. Budgeting apps sync with your accounts to provide real-time spending data, while simple spreadsheets offer complete customization. The method matters less than the consistency. As you review, ask yourself: Are my spending patterns aligning with my priorities? What adjustments would make this budget work better for me? This ongoing dialogue with your finances builds awareness and control.

Setting Financial Goals and Maintaining Discipline

Budgeting without goals is like driving without a destination - you might enjoy the ride, but you won't necessarily arrive anywhere meaningful. Specific, time-bound goals give your budget purpose and motivation. Whether it's saving $5,000 for a dream vacation in 18 months or paying off $10,000 in credit card debt within two years, these targets focus your financial energy.

Discipline doesn't mean rigidity. It's about making conscious choices that align with your goals. When temptation strikes (and it will), remind yourself of what you're working toward. Financial therapist Amanda Johnson suggests, Create visual reminders of your goals - pictures of that vacation spot or your debt-free celebration - to keep you motivated when willpower wanes.

Beyond the Basics: Advanced Budgeting Strategies for Growth

Understanding Your Spending

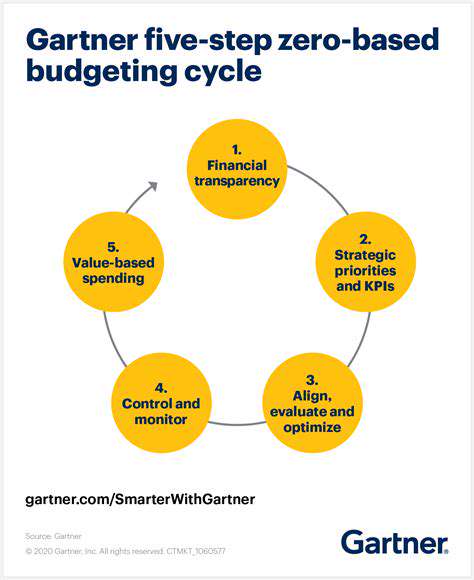

Advanced budgeting moves beyond simple tracking to analyzing the psychology behind your spending. Every dollar you spend reflects a choice and a value. Are you spending on things that truly enhance your life, or are you falling into emotional spending traps? This deeper analysis can reveal surprising patterns and opportunities for meaningful change.

Establishing Realistic Financial Goals

Sophisticated budgeting ties directly to goal-setting theory. The SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound) transforms vague aspirations into actionable plans. For example, instead of save more money, try Increase my 401(k) contribution by 2% each quarter until reaching 15% of my salary. This level of specificity creates accountability and makes progress measurable.

Incorporating Unexpected Expenses

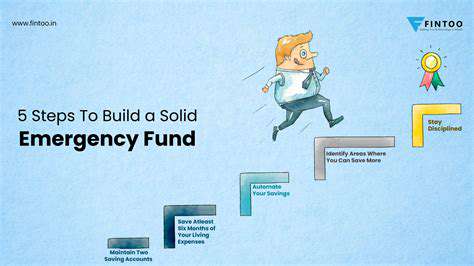

True financial resilience comes from expecting the unexpected. While we can't predict every crisis, we can build buffers. A robust emergency fund covering 3-6 months of expenses is your first line of defense. Beyond that, consider creating specific sinking funds for predictable irregular expenses like car repairs or home maintenance. This layered approach prevents financial shocks from derailing your progress.

Maximizing Investment Opportunities

As your budget stabilizes, focus shifts from mere saving to strategic wealth-building. The power of compound interest means starting early can make a dramatic difference in long-term outcomes. Even small, consistent investments in index funds or retirement accounts can grow significantly over time. The key is developing an investment strategy that matches your risk tolerance and time horizon.

Utilizing Budgeting Tools and Techniques

Advanced budgeters leverage technology to gain insights. Apps that categorize spending, forecast cash flow, and track net worth provide valuable data points. Regular financial check-ups using these tools can reveal opportunities to optimize, whether that's refinancing debt, adjusting insurance coverage, or rebalancing investments.

Reviewing and Adjusting Your Budget Regularly

Life changes, and so should your budget. Major events like career changes, family additions, or health developments require budget reassessments. An annual comprehensive review with quarterly check-ins keeps your financial plan aligned with your current reality and future aspirations. This proactive approach prevents small issues from becoming big problems.

Budgeting for Specific Life Stages: Tailoring Your Approach

Early Adulthood: Establishing Financial Foundations

Your twenties and thirties present unique financial challenges and opportunities. This is the time to develop healthy money habits that will serve you for decades. Focus on building emergency savings, contributing to retirement accounts (even small amounts), and avoiding lifestyle inflation as your income grows. The financial decisions you make now compound over time, for better or worse.

Mid-Career: Balancing Career and Family

This stage often brings competing financial priorities - advancing your career, raising a family, and preparing for the future. Strategic budgeting becomes crucial to balance present needs with long-term security. This might mean maximizing retirement contributions while also saving for college expenses, or investing in career development while maintaining adequate insurance coverage.

Starting a Family: Preparing for the Future

The arrival of children transforms financial priorities overnight. Beyond immediate expenses like childcare, smart budgeting now includes planning for future education costs and ensuring adequate life insurance. Many parents find value in creating separate savings buckets for different family goals, making it easier to track progress toward each objective.

Retirement Planning: Securing Your Golden Years

As retirement approaches, budgeting shifts from accumulation to distribution planning. Understanding your retirement income streams and projected expenses is essential for creating a sustainable withdrawal strategy. This phase also involves important decisions about Social Security timing, healthcare coverage, and potential downsizing.

Managing Debt: Strategies for Repayment

Effective debt management requires more than minimum payments. The avalanche method (targeting highest-interest debt first) typically saves the most money, while the snowball method (paying smallest balances first) provides psychological wins. Choose the approach that best matches your personality and financial situation.

Downsizing and Transition: Adapting Your Budget

Major life transitions demand budget reassessment. Whether it's an empty nest, relocation, or career change, take time to understand how your cash flow will change and adjust your spending plan accordingly. These transitions often present opportunities to reallocate resources toward new priorities.

Maximizing Your Savings and Investments: Strategies for Financial Freedom

Understanding Your Financial Goals

Clarity about what you're working toward transforms saving from obligation to empowerment. Vivid, emotionally compelling goals create stronger motivation than vague notions of being responsible. Whether it's financial independence, world travel, or leaving a legacy, connect your savings strategy to your deepest values.

Budgeting and Tracking Expenses

The foundation of all saving is spending less than you earn. Conscious spending - where every dollar has a purpose - creates more satisfaction than mindless consumption. Advanced savers often use techniques like the 24-hour rule for non-essential purchases or setting monthly spending challenges to stay engaged with their financial goals.

Building an Emergency Fund

Financial security begins with liquidity. An emergency fund isn't just about the dollars - it's about the peace of mind and options it creates. Start small if necessary, but make consistent contributions automatic. High-yield savings accounts keep this money accessible while earning modest returns.

Exploring Savings Accounts and Certificates of Deposit

While not glamorous, these tools play important roles in a balanced financial plan. Laddering CDs can provide better rates while maintaining some liquidity, and online banks often offer higher yields than traditional institutions. Understand the trade-offs between access and return when allocating short-term savings.

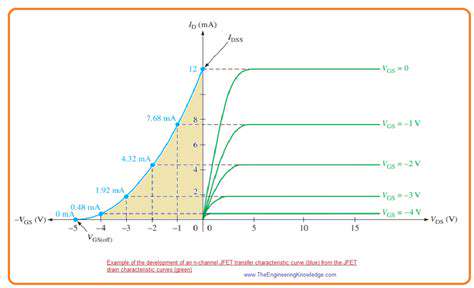

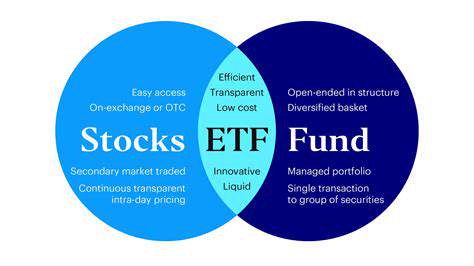

Investing for Growth: Stocks and Bonds

Long-term wealth building requires moving beyond savings accounts. The stock market's historical average return of about 7% after inflation makes it one of the most powerful wealth-building tools available. Index funds provide diversification and low costs, making them ideal for most individual investors. Asset allocation should reflect your timeline and risk tolerance.

Seeking Professional Financial Advice

Complex financial situations often benefit from expert guidance. A good financial advisor doesn't just pick investments - they help align your entire financial life with your goals and values. Look for fee-only advisors who act as fiduciaries, putting your interests first. The right advisor can pay for themselves many times over in optimized strategies and avoided mistakes.

Regular Review and Adjustments

Financial planning isn't a set-it-and-forget-it activity. Schedule regular money dates to review progress, celebrate wins, and make course corrections. These check-ins keep you engaged with your financial life and allow you to adapt to changing circumstances or opportunities. Consistency in this practice compounds just like your investments.

Read more about Best Budgeting Books to Read in 2025

Hot Recommendations

- Tax Planning Tips for Homeowners [2025]

- How to Get Insurance for a Short Term Rental Property

- Understanding the Benefits of a Roth IRA

- How to Manage Business Debt After a Downturn

- How to Use a Barbell Investment Strategy

- Best Ways to Track Your Progress Towards Financial Freedom

- Tips for Managing Credit Card Rewards While Paying Off Balances

- Tax Planning Tips for Stock Options

- How to Plan for Retirement if You Didn't Save Early

- Guide to Managing Legal Debt

![How to Build an Emergency Fund [Step by Step]](/static/images/30/2025-04/Step53AReplenishYourEmergencyFundWhenNecessary.jpg)

![Best Investment Strategies for Volatile Markets [2025]](/static/images/30/2025-05/StrategicAssetAllocation3AAdaptingtoMarketConditions.jpg)